DailyMail Money: First Time Buyers and the Impact of Falling Mortgage Rates

Current Monthly Mortgage Payments

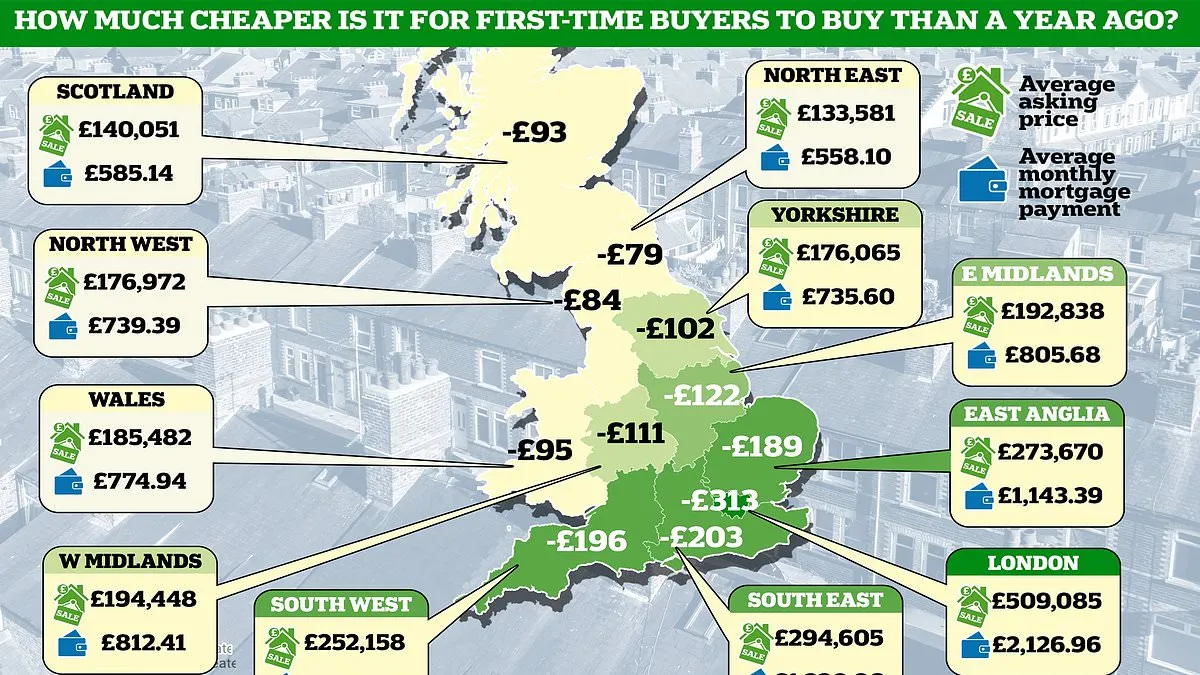

Monthly mortgage payment is now £949, compared with £1,096 last July. This significant drop is turning heads and prompting potential homeowners to reconsider their options.

Dramatic Changes in the Mortgage Landscape

As financing options become more favorable, many are asking if first time buyers can finally seize the moment. This shift in mortgage rates offers intriguing opportunities.

- Increased Affordability: First time buyers can benefit from reduced monthly payments.

- Market Trends: Understanding local market fluctuations is key.

- Buyer Sentiment: How do these changes affect buyer confidence?

What Lies Ahead?

With ongoing fluctuations, the question remains: are these first time buyers ready to jump in?

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.