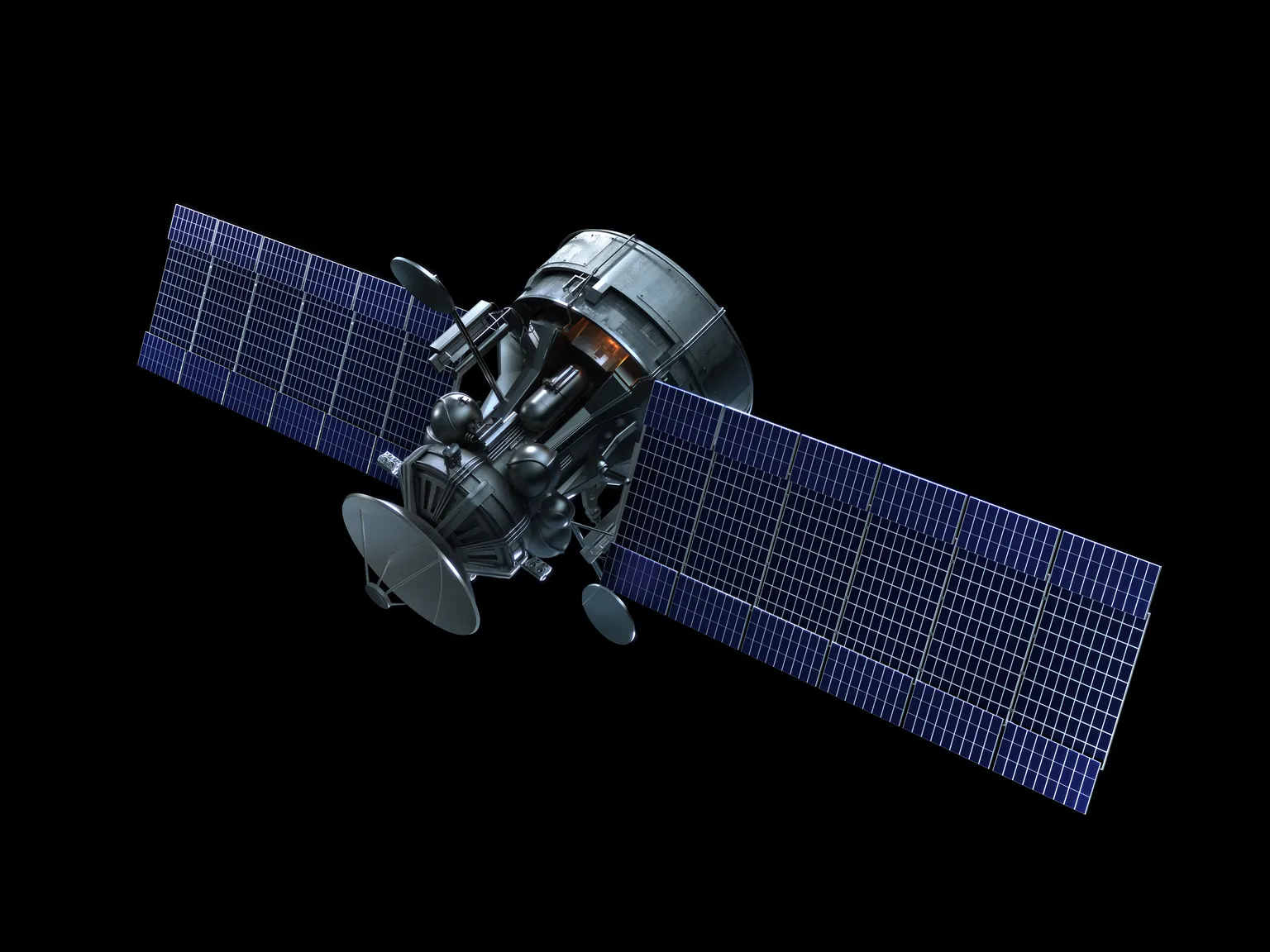

EchoStar Stock Analysis: Balancing Dangerous Debt with Spectrum Potential

Exploring EchoStar's Financial Landscape

EchoStar Corporation (NASDAQ:SATS) is grappling with serious financial hurdles. The company's warning about its going concern has raised eyebrows among investors, particularly amidst declining cash flow and maturing debt due in 2024. Despite these risks, EchoStar might be on the brink of a breakthrough, given its enormous spectrum capacity that could reshape its financial outlook.

Current Financial Challenges

- Going concern warning raises red flags.

- Cash flow decline threatens operational stability.

- Debt maturing in 2024 adds pressure to financials.

Potential Opportunities Ahead

- The company holds a vast spectrum potential that could lead to recovery.

- Investment in innovative solutions may enhance income streams.

- Strategic partnerships could unlock new avenues for growth.

In conclusion, while EchoStar's immediate outlook is clouded by significant challenges, the potential benefits of its spectrum holdings cannot be overlooked. Careful consideration will be essential for stakeholders analyzing the dynamics of NASDAQ:SATS.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.