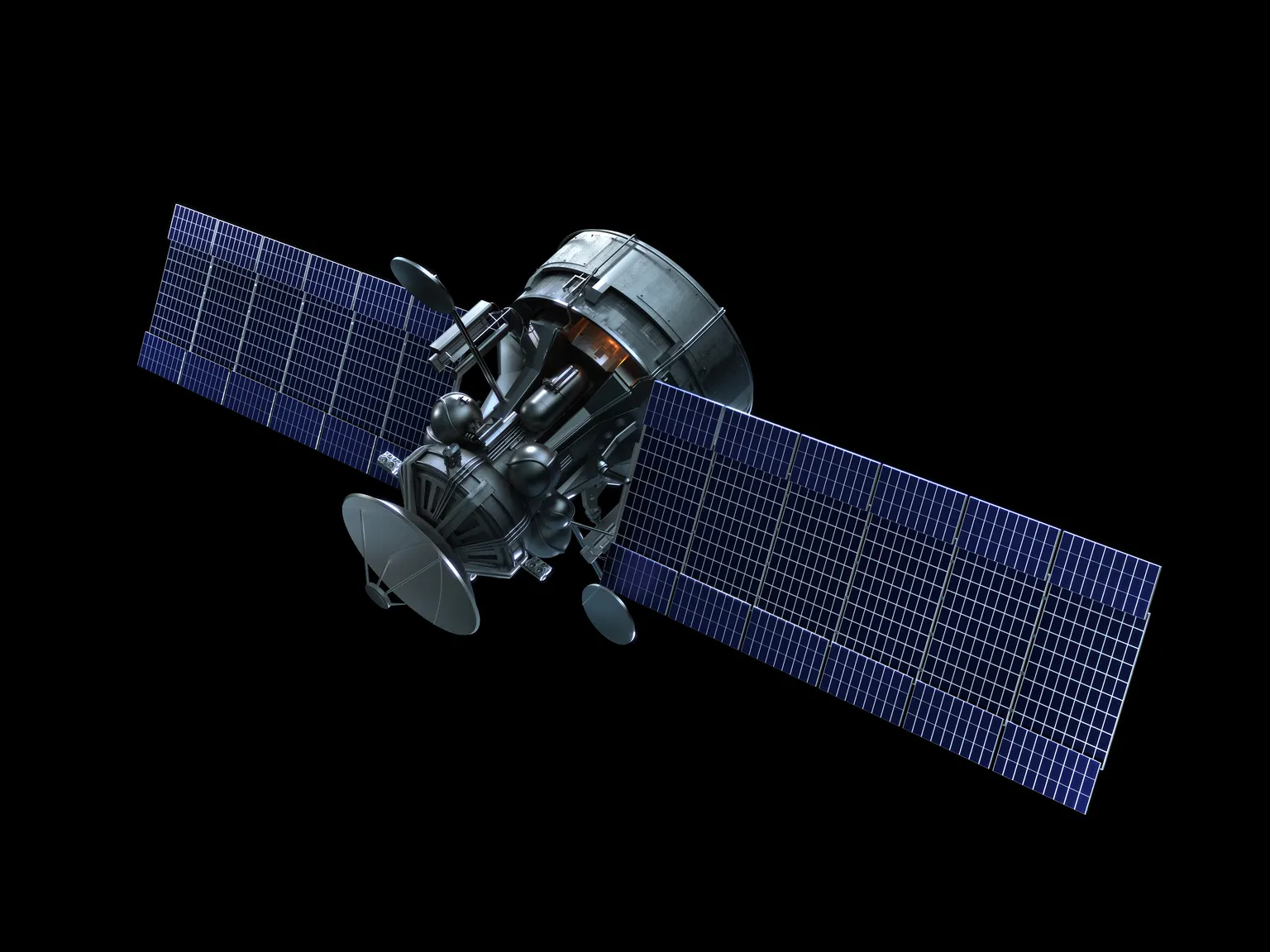

EchoStar Stock Analysis: Balancing Dangerous Debt and Spectrum Opportunities

EchoStar Stock: Analyzing Dangerous Debt

EchoStar Stock is currently grappling with serious financial hurdles. The company faces a going concern warning due to its mounting debts and a risk of default.

Debt and Cash Flow Challenges

- Debt maturing in 2024 poses significant threats.

- Declining cash flow raises alarms about operational sustainability.

Massive Spectrum Potential

Despite these challenges, there is a silver lining. The company’s spectrum assets present massive potential for future revenue streams.

Investment Considerations

Investors should carefully weigh the risks associated with EchoStar's financial situation against the promising spectrum opportunities. Strategies for investment decisions should include thorough market analysis.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.