EchoStar Stock Analysis: Balancing Debt Risk with Spectrum Potential

EchoStar's Financial Struggles and Spectrum Value

EchoStar Stock, listed as NASDAQ:SATS, is currently grappling with serious financial challenges. The company has issued a going concern warning due to its declining cash flow and debt maturing in 2024. Investors need to assess these risks carefully.

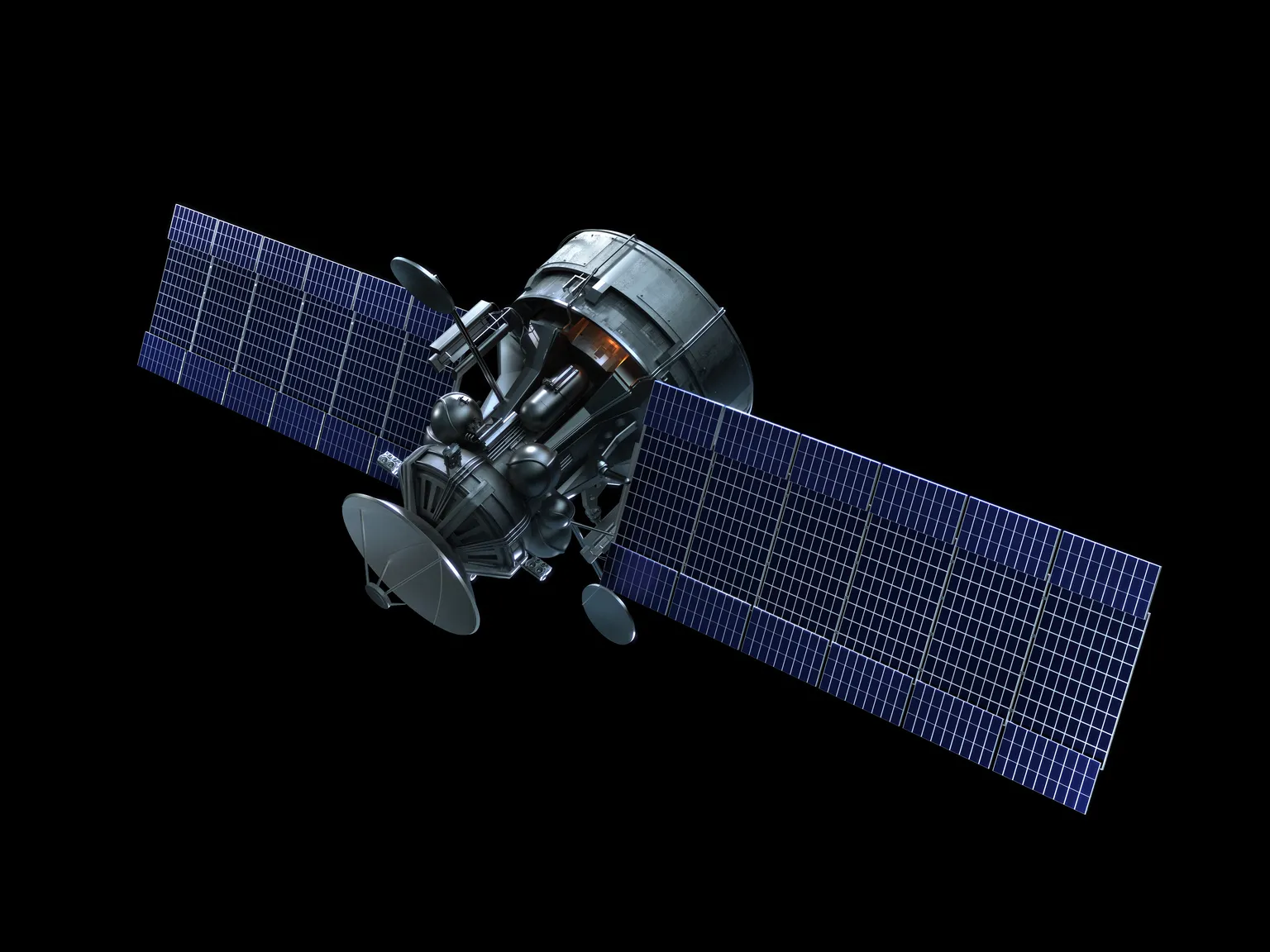

The Spectrum Advantage

Despite these challenges, EchoStar possesses significant spectrum potential. As the demand for bandwidth continues to grow, this asset could yield substantial returns if leveraged effectively.

- Current Debt Issues: EchoStar’s debt situation is deteriorating, attracting attention from analysts.

- Cash Flow Declines: Persistent cash flow drops could hinder operations.

- Spectrum Opportunities: Significant potential in spectrum leasing and services.

The juxtaposition of dangerous debt and valuable assets makes EchoStar a compelling, albeit risky, investment consideration.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.