EchoStar Stock Analysis: Balancing Debt Challenges and Spectrum Opportunities

EchoStar's Current Financial Status

EchoStar, identified by the ticker SATS, is grappling with significant challenges. The company is confronted by a going concern warning, coupled with declining cash flow and impending debt obligations due in 2024. This precarious financial state raises concerns among investors, cautioning against investment.

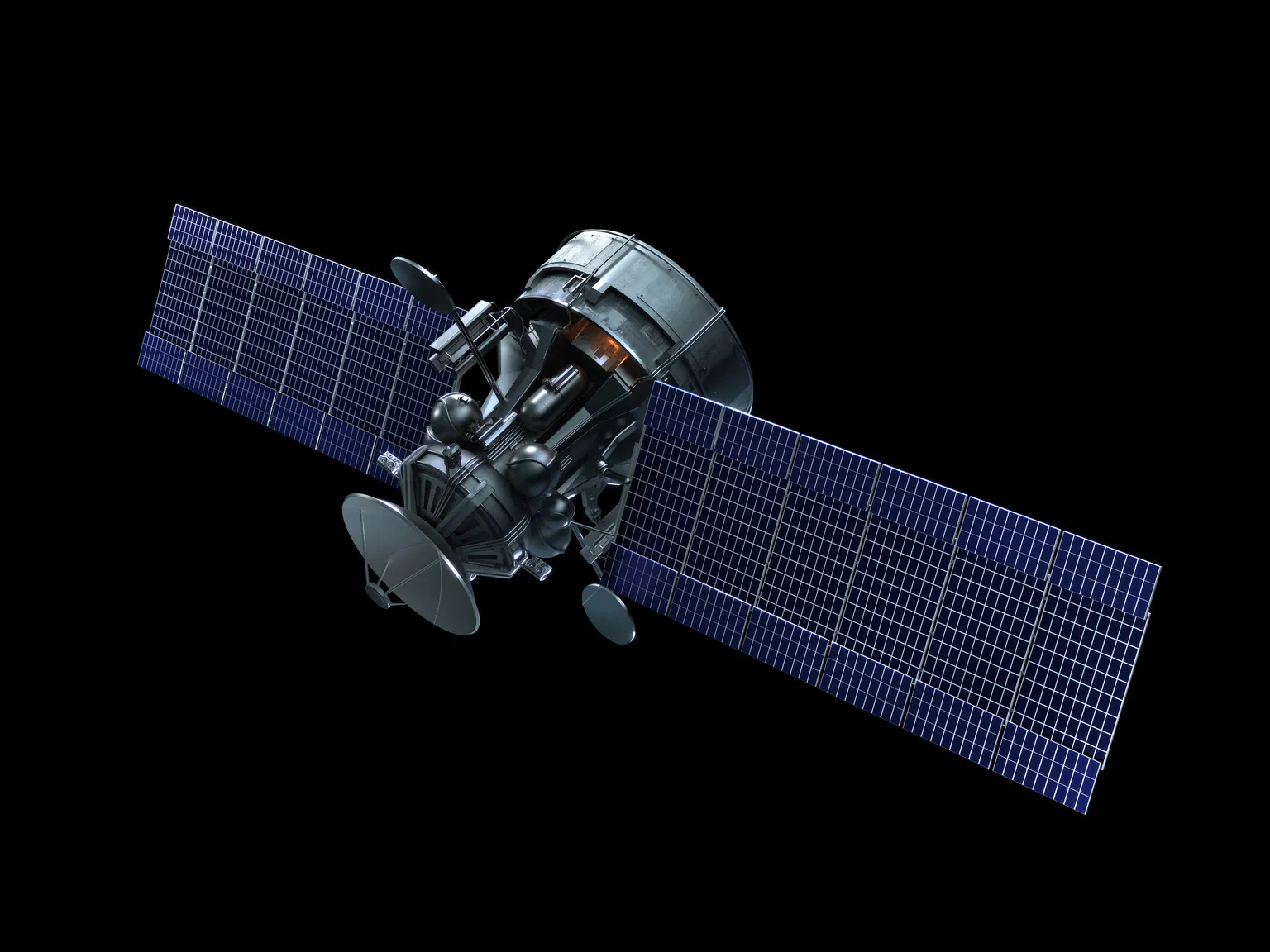

Exploring Spectrum Potential

Despite the pressing issues, there is a massive upside potential tied to EchoStar's spectrum holdings. The company owns valuable assets, which could lead to strategic partnerships or monetization opportunities, potentially stabilizing its financial condition.

Investor Considerations

Investors should approach EchoStar with cautious optimism. Monitoring the evolving financial landscape and management's strategies towards debt adjustment and spectrum utilization will be crucial in making informed decisions.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.