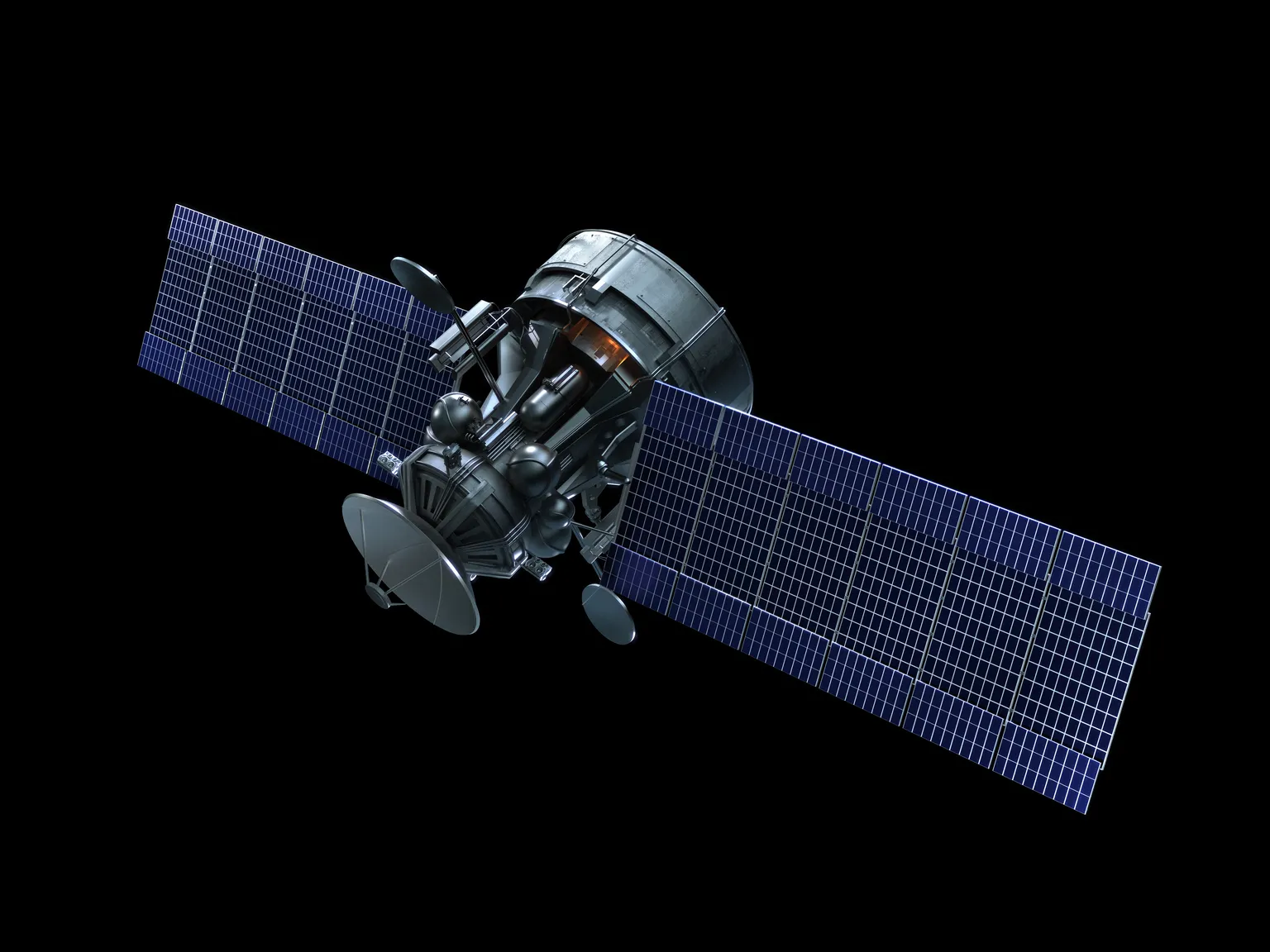

EchoStar Stock: Analyzing Debt Risks and Spectrum Opportunities

Exploring EchoStar's Debt Challenges

EchoStar faces significant financial hurdles with a going concern warning due to declining cash flow. As debt maturity looms in 2024, the need for strategic financial management becomes critical. Investors should be aware of the potential impacts of these challenges on the company's stock performance.

Potential of Spectrum Assets

Despite the troubling financial indicators, EchoStar holds vast spectrum potential. The company could leverage its spectrum assets to fuel growth and stabilize operations. Positioned well, these assets could lead to new revenue streams, offsetting current debts and providing a pathway to recovery.

Key Insights

- Debt Management: Timely actions required to address maturing debts.

- Spectrum Leverage: Utilizing spectrum assets could enhance financial standing.

- Future Projections: Expected performance hinges on debt resolution and spectrum strategy.

Conclusion

Investors in EchoStar must navigate a landscape filled with risk due to its financial challenges. Nevertheless, the company's spectrum holdings present a significant opportunity that could lead to improved financial health if managed wisely.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.