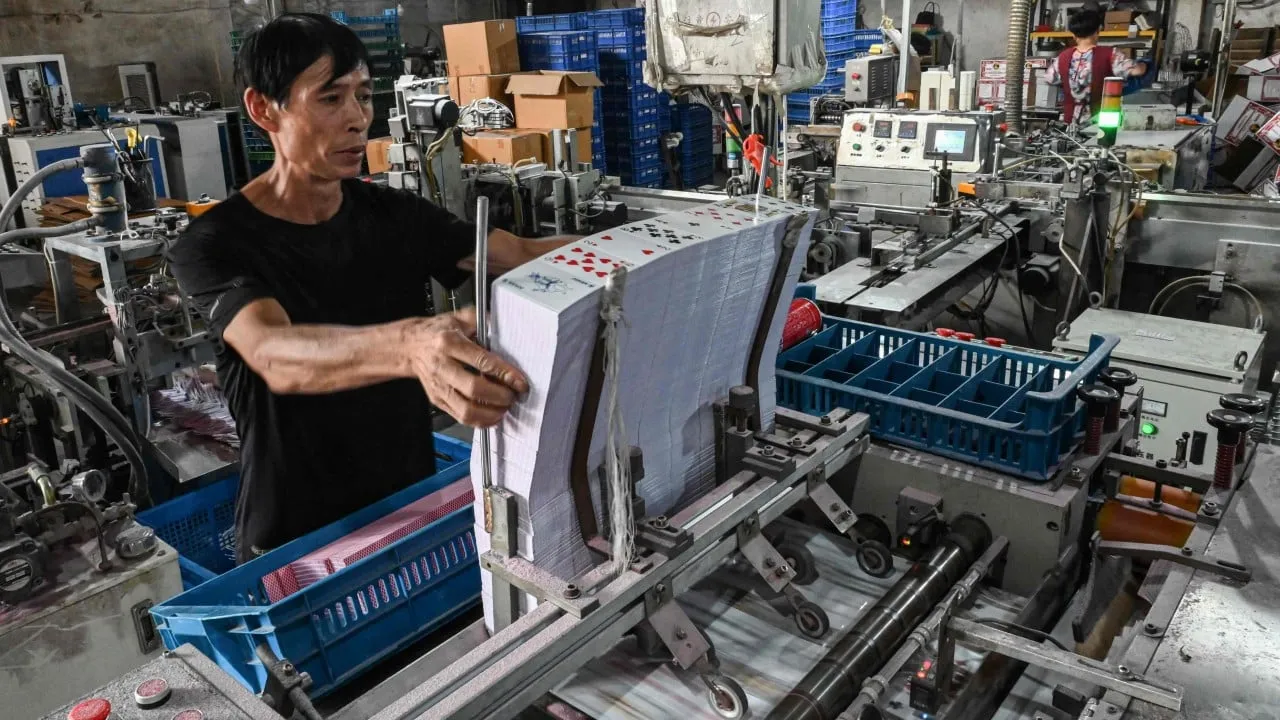

China PMI Declines, Indicating Factory Activity Contraction and Economic Recovery Concerns

Manufacturing Activity in China Shows Signs of Contraction

According to China's latest purchasing managers index (PMI), factory activity remains in contraction for the fourth month running.

The PMI recorded a reading of 49.1 in August, a subtle decline from 49.4 in July, indicating that economic recovery may be faltering. This reading, which is below the critical level of 50, signifies a reduction in manufacturing activity.

Expert Insights on Manufacturing Activity

- Zhang Zhiwei, chief economist at Pinpoint Asset Management, warns that China's economic momentum has weakened.

- According to him, the fiscal policy remains restrictive and requires a shift to more supportive measures.

Exports and PMI Subindices

Within the manufacturing PMI, the new manufacturing export order subindex reached 48.7 in August, slightly improving from 48.5 in July. However, with US economic slowing, exports may prove to be a less reliable growth source.

For the non-manufacturing PMI, which covers services and construction, August recorded 50.3, slightly better than July's 50.2. This metric suggests ongoing expansion in services despite the broader economic challenges.

Current Economic Climate and Future Outlook

- China's economy expanded by 4.7 percent in the second quarter, falling short of predictions.

- UBS has adjusted its 2024 GDP growth forecast for China from 4.9 percent to 4.6 percent.

- Expectations for fiscal policy changes include increased governmental bond issuance and modest monetary easing.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.