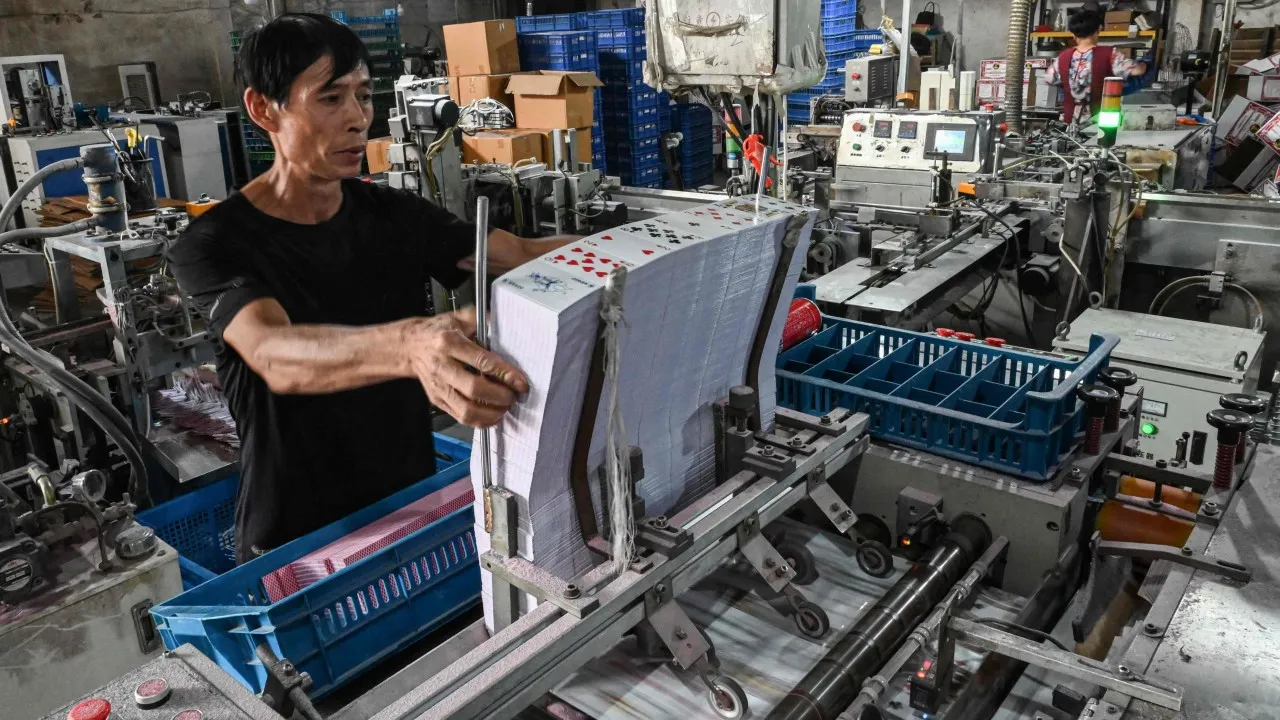

China Manufacturing PMI Indicates Contraction Amid Economic Recovery Challenges

China's Manufacturing PMI Shows Contraction

China's manufacturing activity remains in contraction, reflecting a weak economic momentum for a fourth consecutive month. The official Purchasing Managers' Index (PMI) dropped to 49.1 in August, down from 49.4 in July, according to the National Bureau of Statistics.

The index falling below 50 signals contraction in economic activity, contrary to expectations set by Bloomberg for a slight rise to 49.5.

Economic Commentary

Zhang Zhiwei, chief economist at Pinpoint Asset Management, indicated, “China’s economic momentum likely weakened recently due to restrictive fiscal policies.” This aligns with the need for more supportive policies to stabilize economic performance.

- New manufacturing export orders subindex at 48.7, slightly improved from 48.5 in July.

- US economic slowdown raises concerns for China’s export-driven growth.

Non-Manufacturing PMI Insights

Meanwhile, the non-manufacturing PMI measures sentiment in the services and construction sectors and stood at 50.3 in August, reflecting expansion for the 20th consecutive month.

- Construction subindex at 50.6, down from 51.2.

- Services subindex rose slightly to 50.2 from 50.

Forecast and Outlook

Despite sluggish growth rates, UBS has recently adjusted its 2024 GDP growth forecast for China down to 4.6% from 4.9%, primarily due to weak domestic demand and a struggling property market. Wang Tao, chief economist at UBS anticipates that “supportive policies” will be implemented in the latter half of 2024, including fiscal spending and monetary easing.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.