Understanding 12 On Your Side: How Low Inflation Impacts Money and the Consumer Economy

12 On Your Side: Inflation's Impact on Money and Consumer Behavior

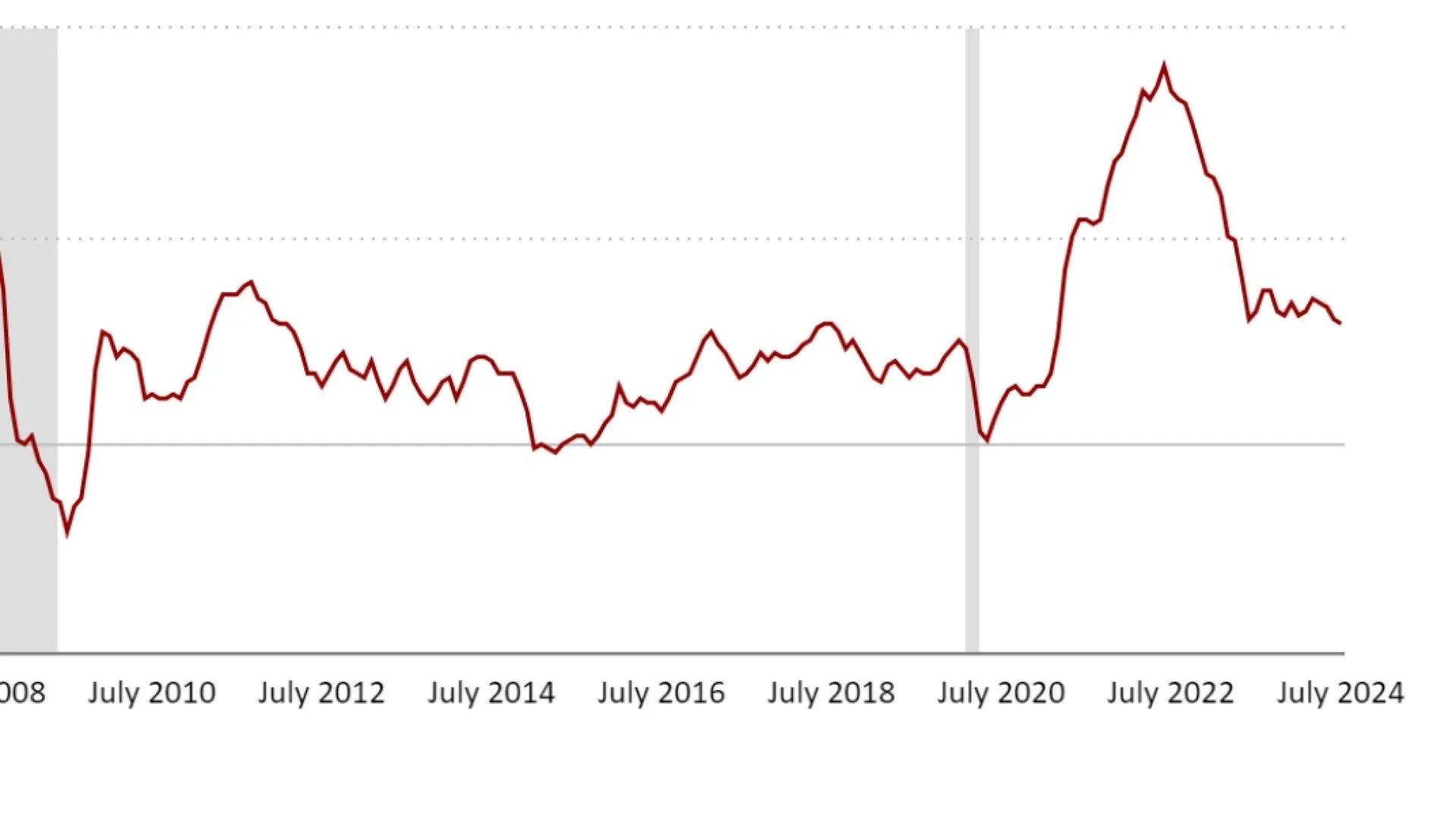

Inflation has seen a notable decline, now at its lowest level in over three years. This development affects everyone, especially how we manage our money. An economist from UTSA’s Institute emphasizes the importance of understanding these shifts through the Consumer Price Index.

Consumer Price Index and Economic Implications

The recent Consumer Price Index data reveals critical trends:

- Reduction in basic consumer goods prices

- Impact on purchasing power for households

- Potential changes in monetary policy from the Federal Reserve

What This Means for Your Wallet

Low inflation translates to:

- Increased purchasing power for consumers

- Stability in essential goods pricing

- Encouragement for spending over saving

The Road Ahead: Economic Outlook

While current trends are positive, it is essential to remain cautious about potential shifts in the economy. As we analyze these developments, keeping informed through reliable sources and expert insights is crucial.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.