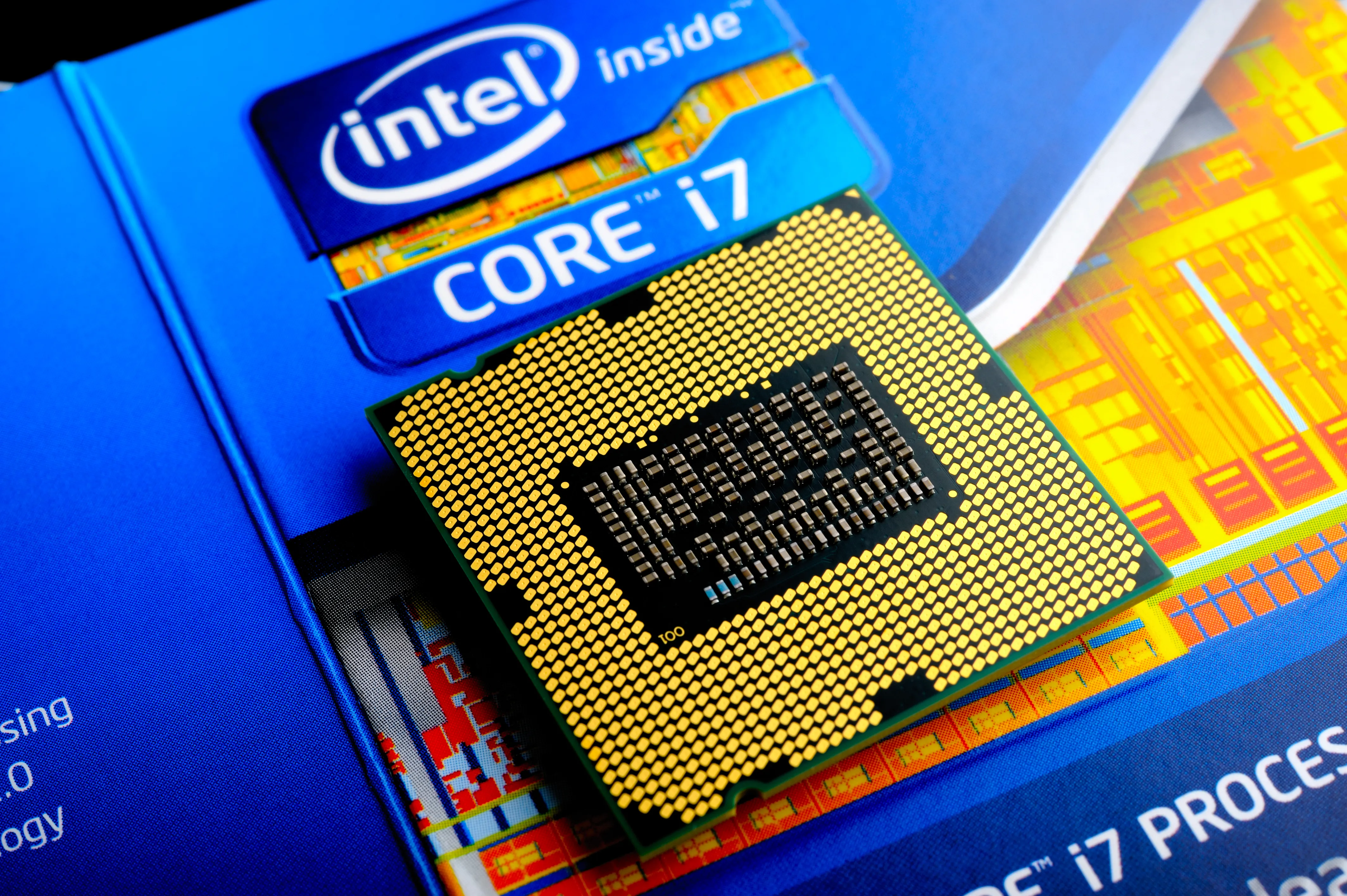

Intel: An In-Depth Investment Analysis of Moat Integrity Amid Financial Challenges

Intel's Financial Struggles

Intel Corporation faces increasing scrutiny as its financial struggles become more evident. High debt levels and uncertain cash flows are threatening the future of this once-dominant player in high-performance gaming.

Understanding the Moat

Investors must consider whether Intel's moat remains intact. The company's ability to fend off competition while managing debt will heavily influence its market position. Rapid advancements in technology pose additional challenges that could impact its profitability.

Key Factors to Watch

- Debt Management: High levels of debt can restrict growth and investment opportunities.

- Market Position: Competitors are increasingly encroaching on Intel's market, demanding strategic responses.

- Cash Flow Uncertainty: Revenue fluctuations can impact funding for research and innovation.

In conclusion, the pressing financial concerns raised in this analysis necessitate close monitoring of Intel's strategies moving forward.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.