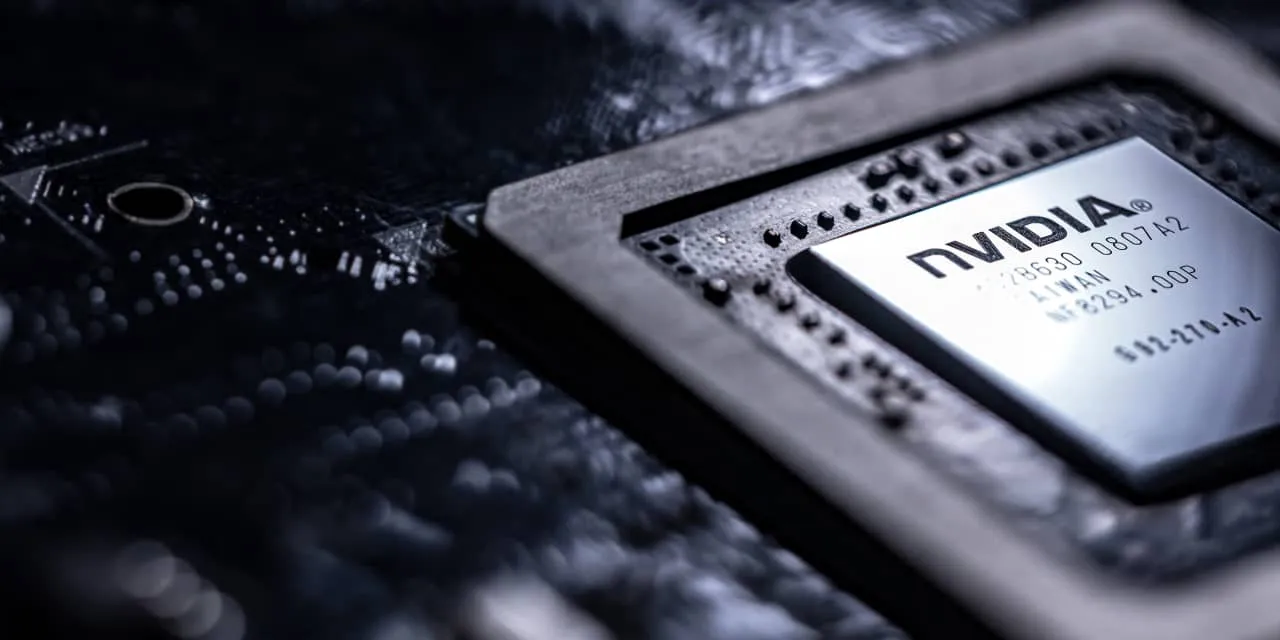

Understanding Nvidia Stock Drop: Earnings Impact, Share Buyback Plan, and Blackwell Chip Update

Analysis of Nvidia Stock Drop

Nvidia's stock closed at $117.59, down $8.02 or 6.4%, marking its lowest close since Aug. 13.

Earnings Report Insights

The disappointing earnings report has raised concerns among investors. Market analysts highlighted that the share buyback plan, while positive, could not mitigate the impact of the disappointing earnings results.

Share Buyback Plan Details

- Nvidia's commitment to repurchase shares aims to boost stock value.

- Investors are keen to see how this will affect long-term performance.

Blackwell Chip Timeline

Developments concerning the Blackwell chip timeline have also contributed to market sentiment. Delays or challenges faced during its rollout could further affect Nvidia's competitive stance.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.