Stocks Peak Six Months Before Recession: Insights on Future Performance

Understanding Market Dynamics Pre-Recession

The threat of a U.S. recession has been at the forefront of investors' minds for more than two years now, ever since the Treasury yield curve inverted during the summer of 2022. Investors have been faced with mixed signals from markets and economic data. Fortunately, according to a number of early indicators tracked by Ned Davis Research, the risk of recession remains low. Currently, only two of NDR's 10 indicators are flashing a recession warning, indicating no immediate defensive moves are necessary.

How Markets Perform During Recessions

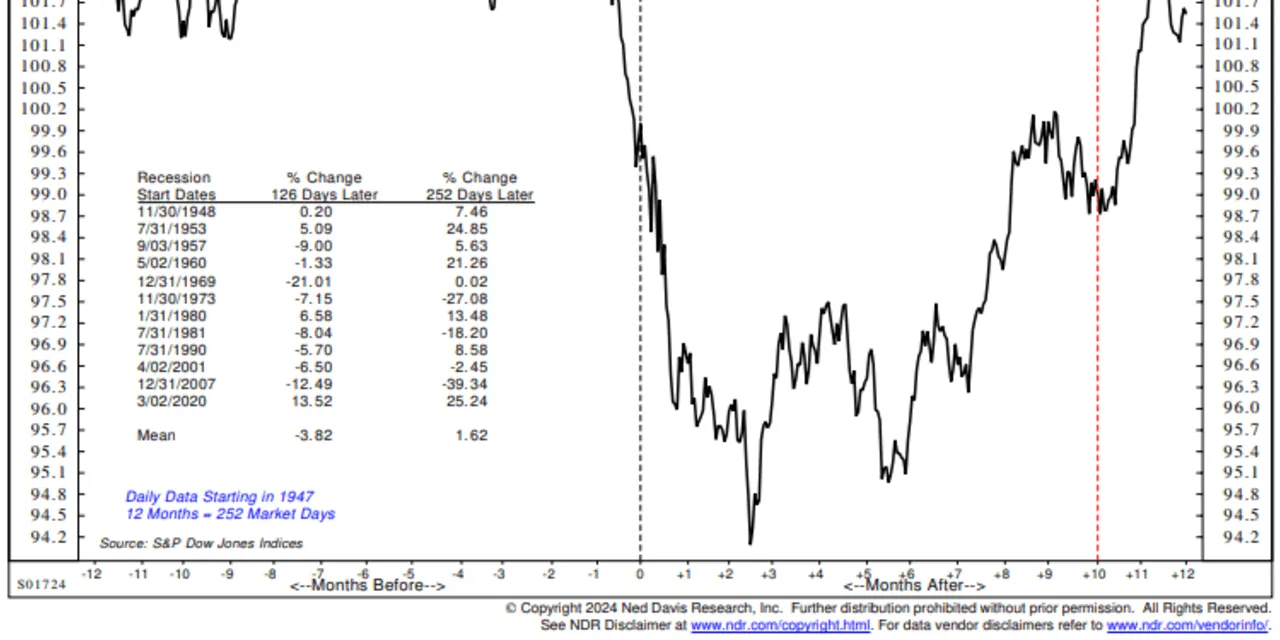

Despite this optimism, it's critical to understand how markets perform during and after a recession. Markets often detect downturns before they are officially recognized. Looking back at historical data, NDR notes that the S&P 500 peaks on average six months prior to a recession declaration by the National Bureau of Economic Research (NBER). Data indicates stocks tend to slide by 3.8% within the six-month window before a downturn begins.

The Recovery Phase

Interestingly, markets generally begin to rebound after the one-year mark into a recession. Historical data showcase that the S&P 500 tends to be up 1.6% from its position at the downturn's start, even if it remains below its pre-recession peak.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.