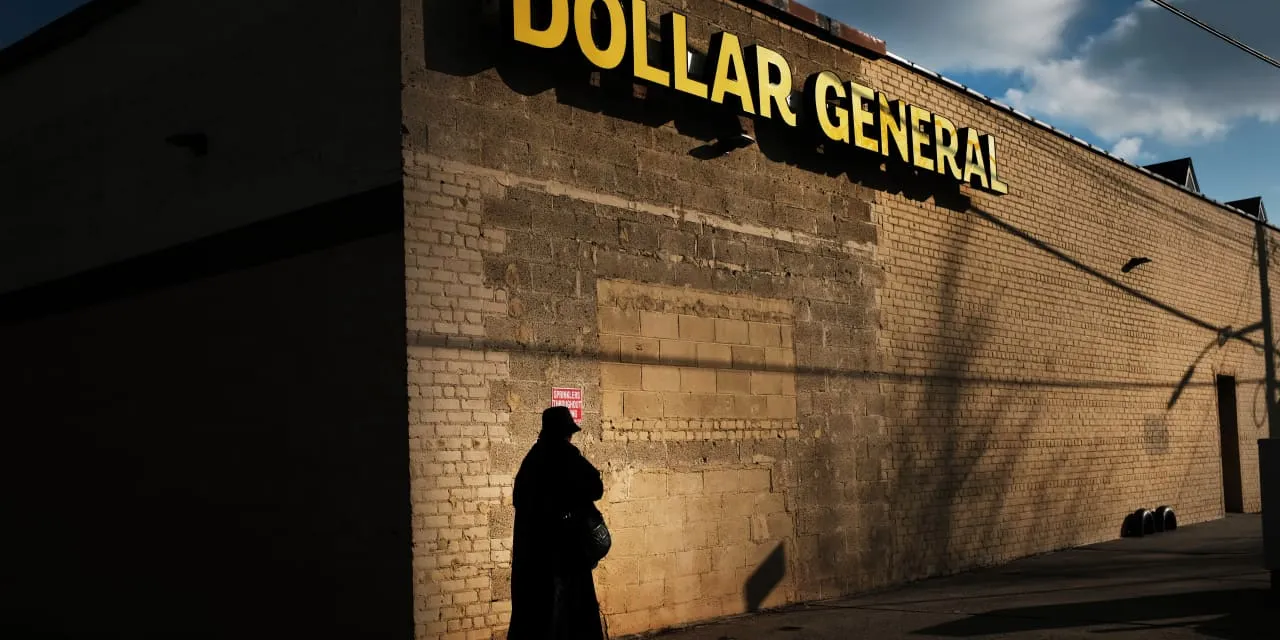

Dollar General Earnings Miss: Analyzing the Impact on Retail and Technology Stocks

Understanding Dollar General's Earnings Report

Dollar General (WMT) recently reported a significant earnings miss, with adjusted earnings coming in at $1.70 per share, falling short of estimates that expected $1.79. This disappointing financial performance has raised eyebrows and prompted a swift 24% decline in stock value.

Sales Figures and Earnings Projections

With sales figures not meeting expectations, the company’s outlook has been significantly affected. Analysts are now concerned about its ability to maintain market presence and growth within the competitive retail landscape.

Sector Impacts

- Mixed Retailing: What does this mean for mixed retailing and discount goods?

- Technology Influence: The interplay between technology and retail strategies in response to earnings performance.

Market Reactions and Future Outlook

Investors are closely monitoring the situation, particularly regarding foreign exchange markets and money markets, as the implications of this earnings report ripple through North America's retail segment.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.