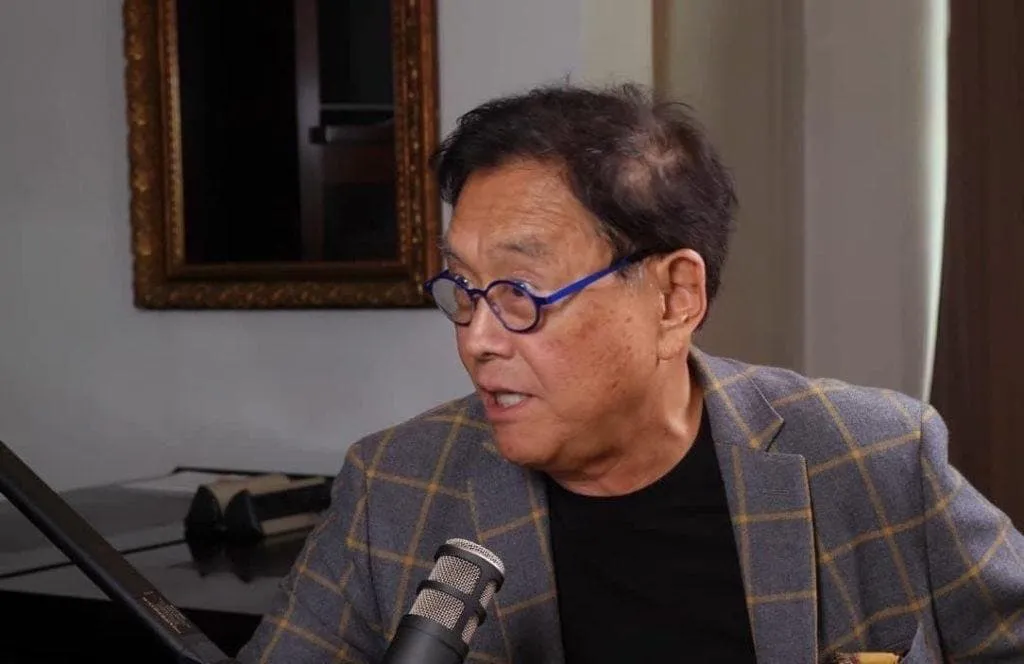

Income Opportunities: Robert Kiyosaki's Take on Real Estate and Taxes

Emphasizing Income Generation through Real Estate

In today's financial climate, income strategies have never been more relevant. Robert Kiyosaki, the renowned author of 'Rich Dad Poor Dad', underscores real estate as a pivotal asset for achieving the ultimate tax-free income.

Trump's Financial Approach

Kiyosaki draws parallels between financial independence and Donald Trump’s tax strategies, stating his ability to generate income from real estate positions him as a smart player in the financial game.

- Most wealth is derived from entrepreneurship and real estate.

- Kiyosaki advises leveraging real estate to create a tax-strategic income.

- Real estate is ideal for those keen on minimizing tax liabilities.

Kiyosaki's Personal Income Strategy

According to Kiyosaki, his personal income strategy includes substantial investment in real estate alongside assets like gold, silver, and Bitcoin. He emphasizes that real estate remains the cornerstone of achieving tax-free income.

The Flexibility of Assets

While expressing admiration for Bitcoin’s liquidity, Kiyosaki cautions investors to recognize the unique benefits that real estate offers for long-term income generation.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.