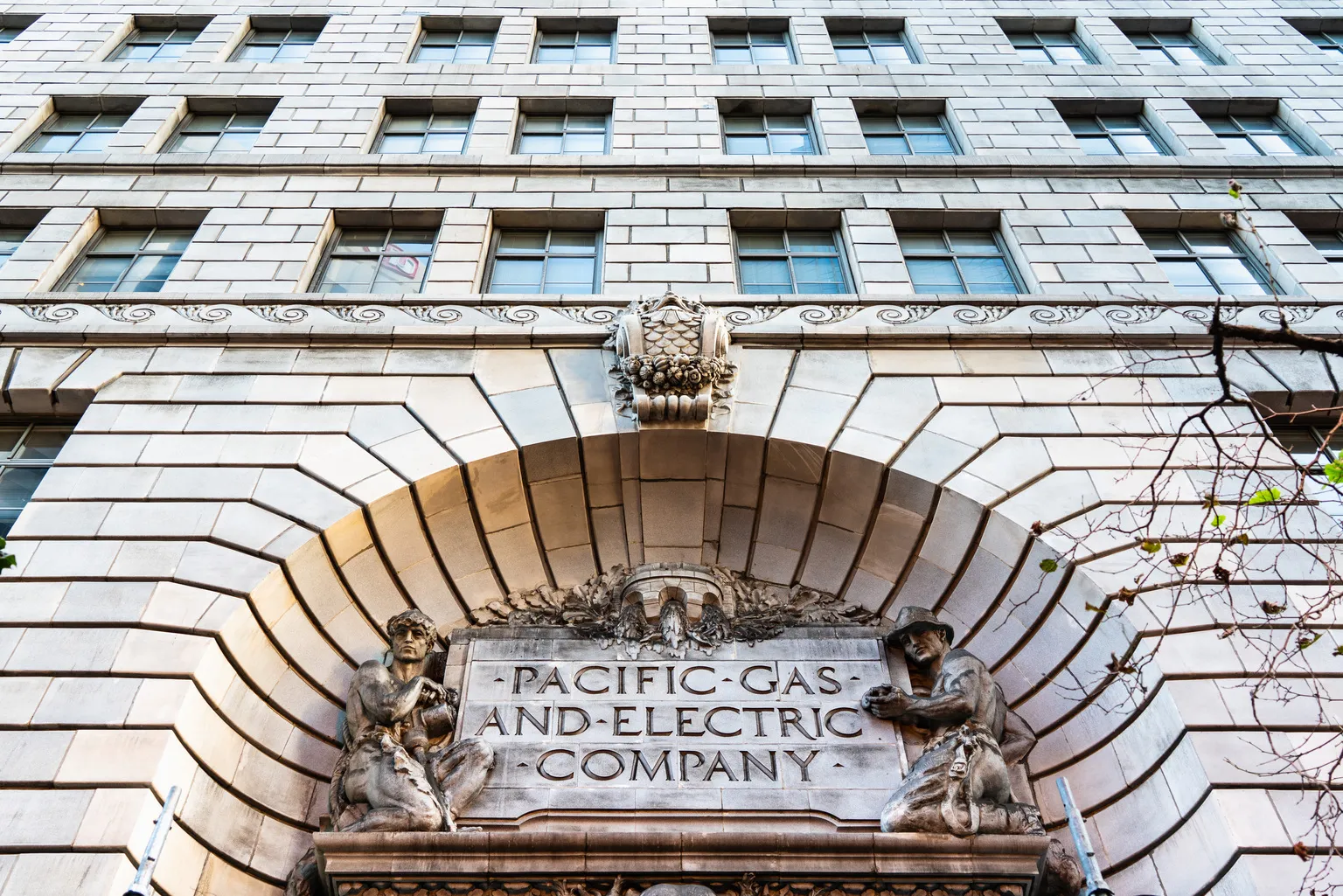

PG&E Corporation's Strategic Approvals and Growth Trajectory

Strategic Approvals Fueling PG&E's Growth

PG&E Corporation is witnessing robust growth attributed to crucial regulatory approvals and strategic project expansions. In Q2’24, the company reported a stunning 13.16% year-over-year revenue growth, indicating a strong operational performance. Furthermore, PG&E has announced an increase in its earnings guidance by 10% for 2025, which is particularly significant for stakeholders.

Future OutLook: Earnings Growth

Looking beyond the immediate results, PG&E is projecting a steady annual earnings growth rate of 9% through 2028. This optimistic forecast reflects confidence in their ability to expand operations and improve profitability amidst a challenging economic landscape.

Investor Insights on PCG Stock

- Monitoring market trends and project impacts

- Analyzing earnings guidance

The market response to these financial developments will undoubtedly influence PCG stock dynamics. Investors should stay informed on upcoming results and regulatory changes, as they will play a pivotal role in shaping the company's trajectory.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.