Artificial Intelligence and the Impact of Hindenburg Research on Super Micro Computer Inc

Artificial Intelligence and Market Dynamics

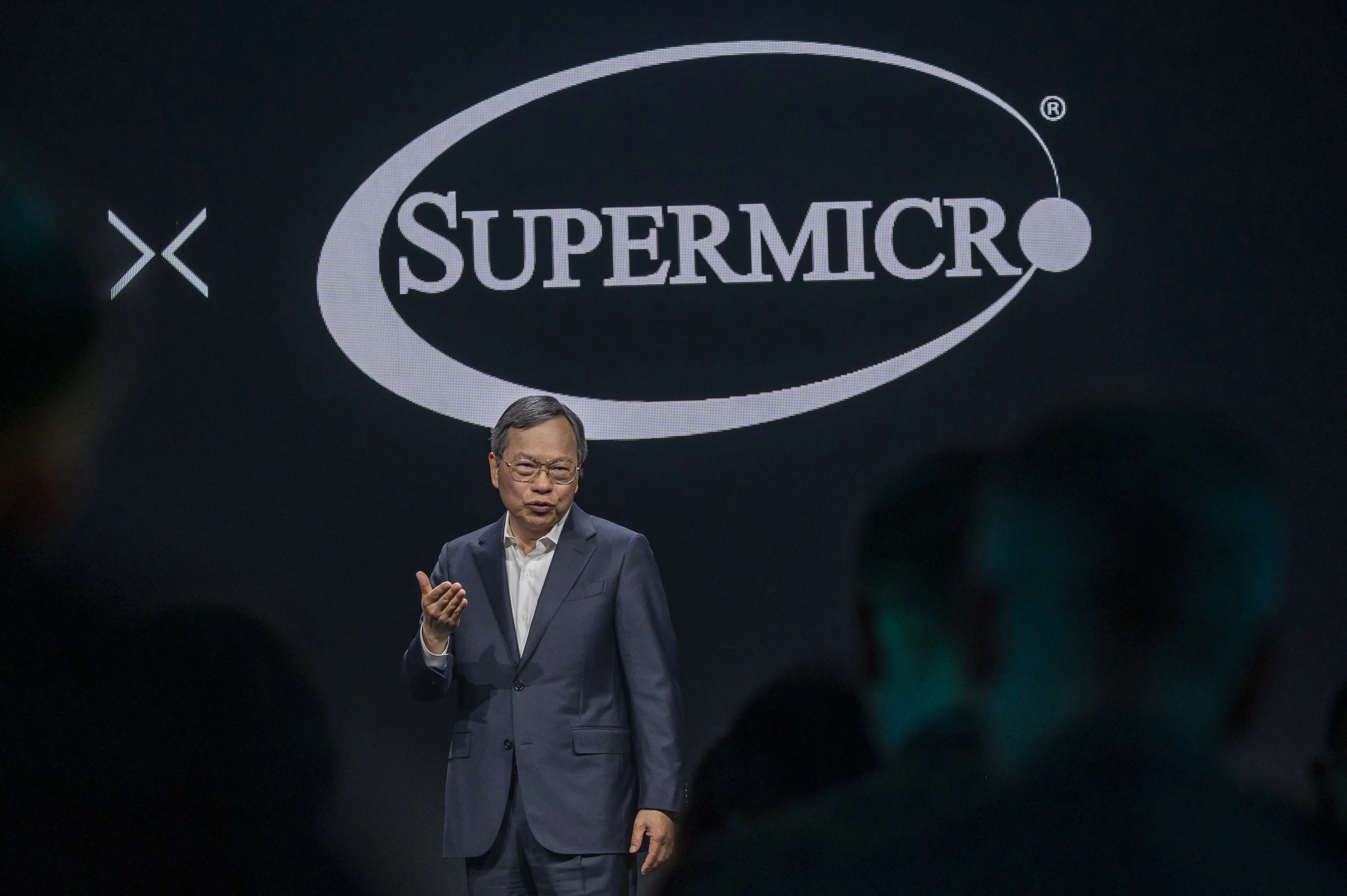

As the landscape of technology shifts, the influence of artificial intelligence has never been more pronounced. Recent reports from Hindenburg Research have highlighted potential issues surrounding Super Micro Computer Inc, leading to a staggering 23% drop in their shares. Investors are now closely examining the intersection of AI development and corporate governance.

Key Factors Influencing Share Price

- Investor Confidence: The report has led to a significant decline in market trust.

- Future Prospects: Questions arose about Super Micro's strategic direction in the rapidly evolving tech environment.

- Market Reactions: Wider ramifications for similar stocks may ensue.

Conclusion and Future Outlook

Moving forward, artificial intelligence will be a core component driving changes in enterprise strategies. Investors should remain vigilant about developments in technology that will influence not only Super Micro but the entire market landscape.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.