Government-Politics: Nebraska's Property Tax Reduction Efforts Fall Short

Government-Politics: Nebraska's Tax Reduction Saga

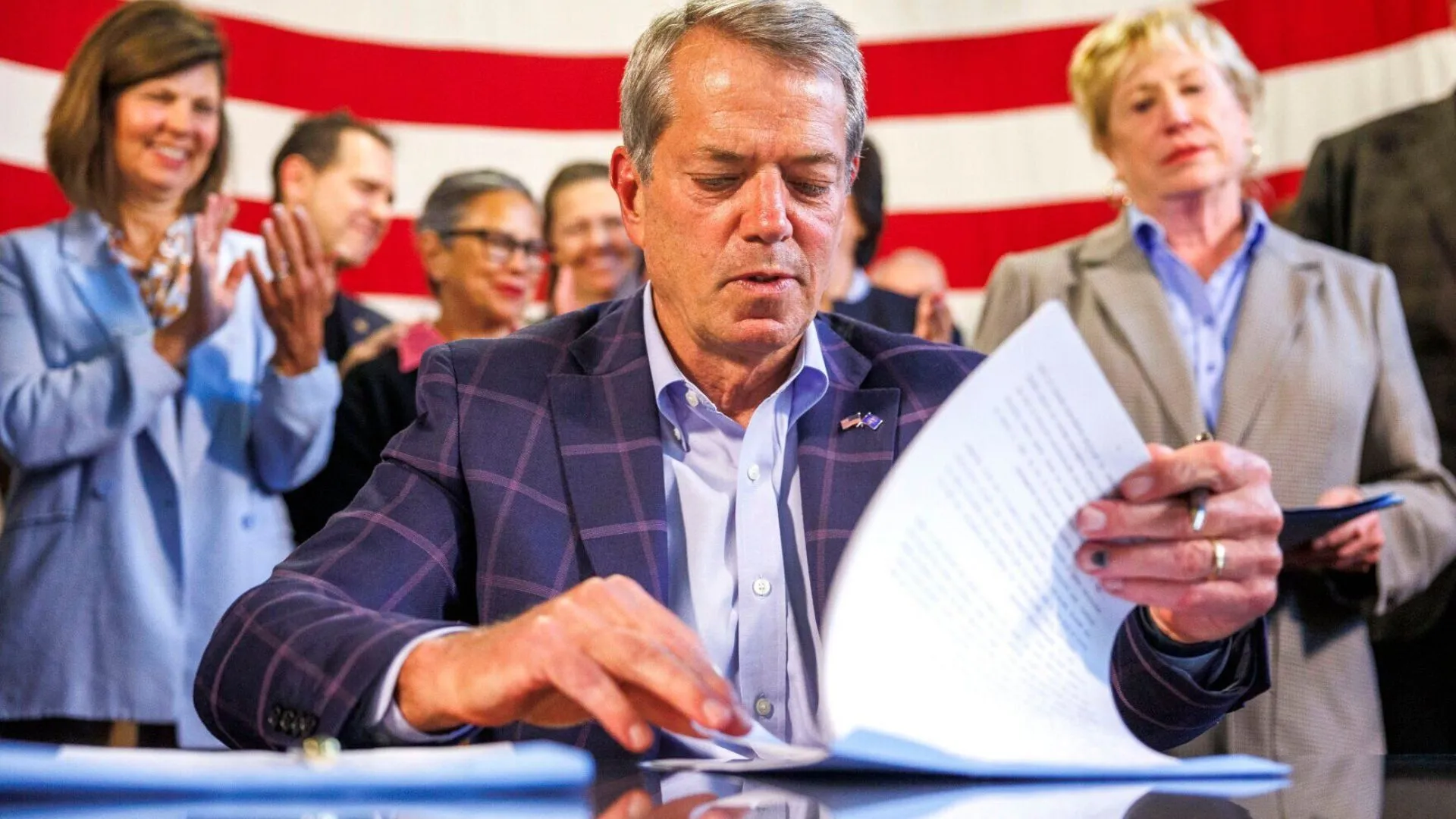

Nebraska Gov. Jim Pillen's ambitious push to slash property taxes by 50% faced significant obstacles, culminating in a disappointing 3% reduction. The ongoing dialogue surrounding taxation policy in Nebraska highlights the challenges leaders face in addressing financial burdens on homeowners.

Implications for Property Owners

- Many residents expected a larger reduction, which could have eased financial pressures.

- The 3% cut leaves many homeowners feeling unresolved and skeptical.

- Potential impacts on local government revenue are a concern for the future.

Political Reactions

Lawmakers and constituents have voiced varied opinions on the effectiveness of this initiative. While some view the 3% as a step in the right direction, others criticize it as insufficient. Exploring these perspectives adds depth to the ongoing conversation about taxation in Nebraska.

Future Directions in Tax Policy

- Continued pressure for more significant reductions may emerge.

- Monitoring the responses from taxpayers and policymakers will be essential.

- Potential adjustments to the tax system could arise from public discourse.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.