Karis Kasarinlan Paolo D. Mendoza Yield Tracker: Analyzing Mixed Yields on Government Securities

Karis Kasarinlan Paolo D. Mendoza Yield Tracker Insights

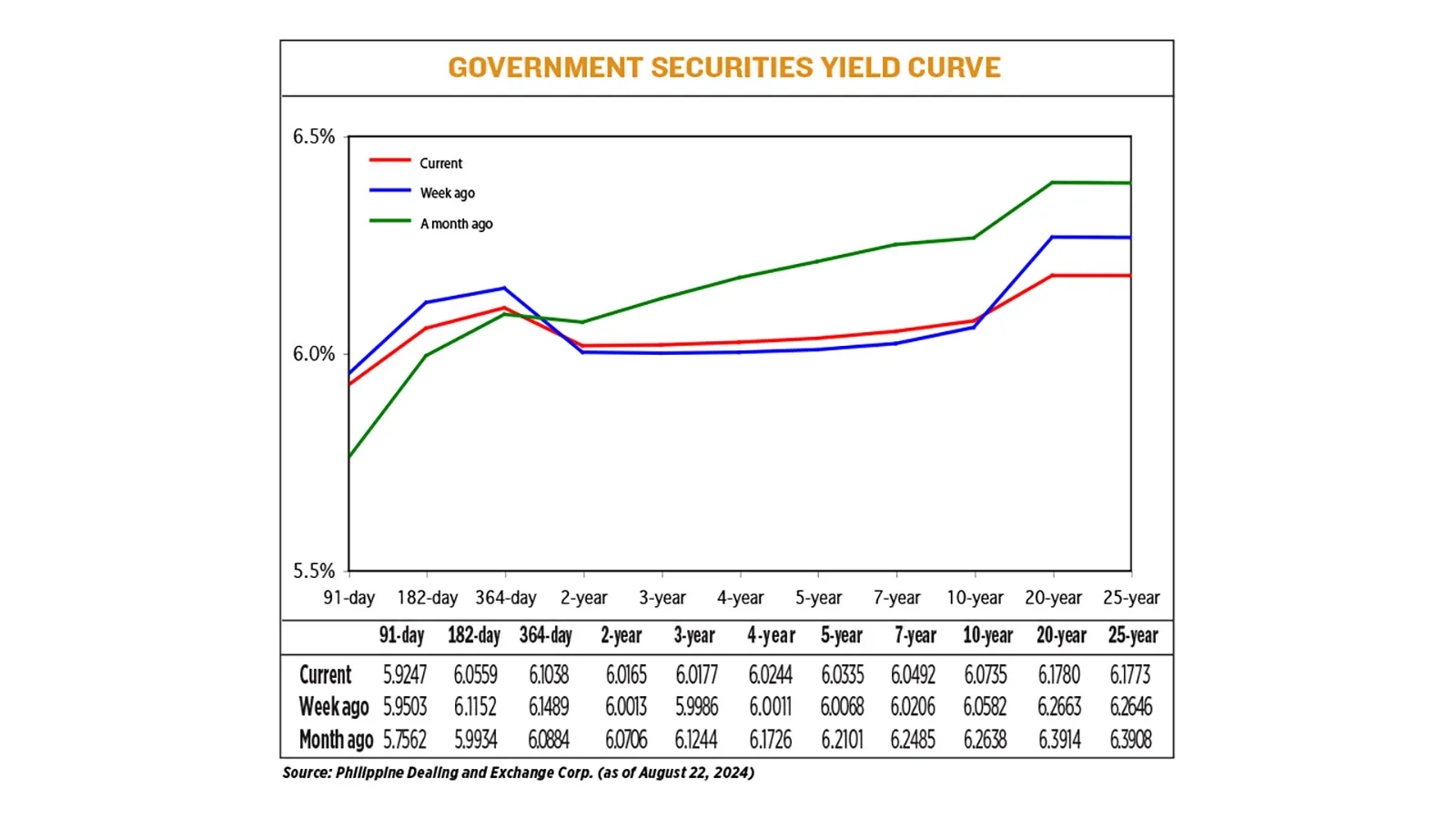

Yields on government securities (GS) ended mixed last week, largely influenced by evolving expectations surrounding rate cuts from the Bangko Sentral ng Pilipinas (BSP) and the US Federal Reserve in the approaching months.

Current Trends in Government Securities

- Mixed Yield Performance: Investors are closely monitoring yield shifts influenced by central bank policies.

- Impact of Federal Reserve: Easing bets from the Fed are altering market perceptions and expectations.

- BSP's Potential Rate Cuts: Anticipated changes from BSP may spur market volatility.

Strategic Financial Implications

For investors, understanding the yield tracker is essential, as it provides clarity into market movements that could reshape investment strategies.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.