Primary Bond Market: How Expected Fed Rate Cut Influences Secondary Bond Market Dynamics

Primary Bond Market Developments

The primary bond market is witnessing a surge in interest as expectations arise concerning the Federal Reserve’s upcoming rate cut. This anticipated shift has prominent implications for the secondary bond market, particularly influencing the municipal bond sector.

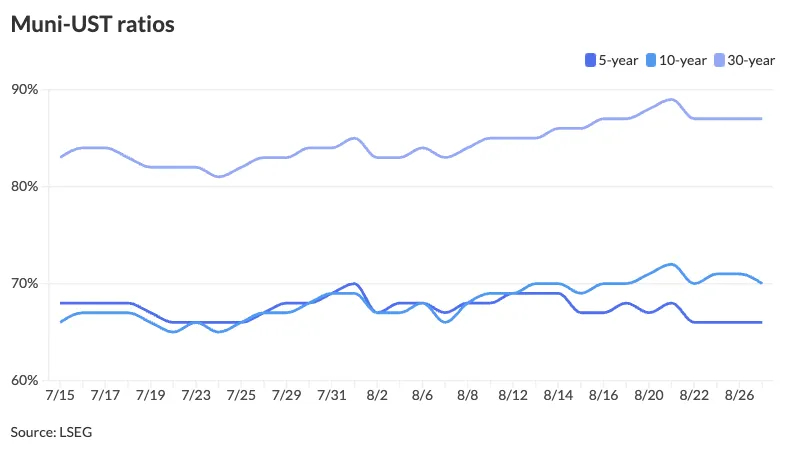

Muni Market Ratios Indicate Positive Trends

As per latest data, the two-year muni-to-Treasury ratio reached 63% on Tuesday, while the 10-year mark is recorded at 70%. The 30-year ratio stands at an impressive 87% as of 3:30 p.m. These ratios reflect growing confidence in the muni market as the Fed prepares to adjust rates.

Impact of Fed Rate Cuts on Public Finance

With rate cuts anticipated from the Fed, the primary bond market is poised for advantageous developments, which could lead to a well-supported Treasury market. Investors looking towards public finance opportunities should consider these evolving dynamics.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.