Autodesk (ADSK) Earnings: What's Expected for Q2 2025

Autodesk Earnings Preview

Autodesk (NASDAQ: ADSK), a leader in design and drafting software, is set to announce its second-quarter earnings on August 29 at 4:00 pm ET. The consensus among analysts is that Autodesk will report earnings of $2.00 per share, up from $1.91 in the prior year, with revenue projected at $1.48 billion.

Market Expectations for Autodesk

Recent trends indicate that Autodesk's stock price has maintained stability, showing a notable recovery after investigations into accounting practices concluded in June. The company has experienced a 20% increase in share value over the past three months, and it is currently trading above its 52-week average.

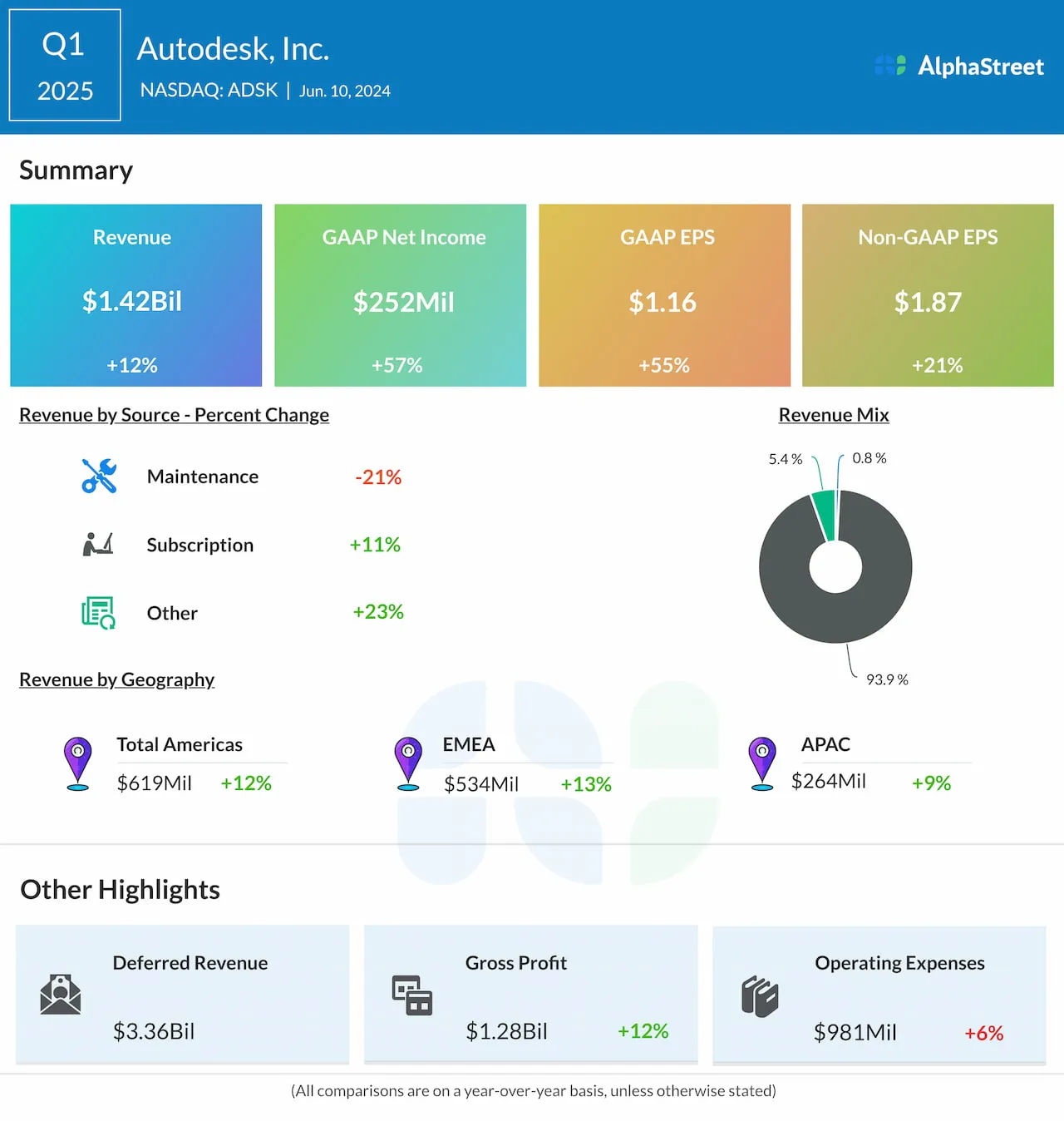

- Strong Q1 2025 Performance: In the previous quarter, Autodesk exceeded both earnings and revenue expectations.

- AI-Powered Design Tools: CEO Andrew Anagnost highlighted the shift to industry clouds and AI services as key to their strategy.

Investor Pressure and Margin Improvements

Activist investors, particularly Starboard Value, have pushed Autodesk to enhance its margin performance and reevaluate board strategies. Recent data reveals an uptick in margins, prompting optimism about Autodesk's operational efficiency moving forward.

Outlook for Fiscal Year 2025

Entering FY25, Autodesk recorded double-digit growth rates, backed by significant increases in subscription revenue, which constitutes over 90% of total earnings. The deferred revenue stands at an impressive $3.36 billion.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.