Corporate Bonds: Investors' Optimism in the Economic Outlook

Corporate Bonds Reflect Investor Optimism

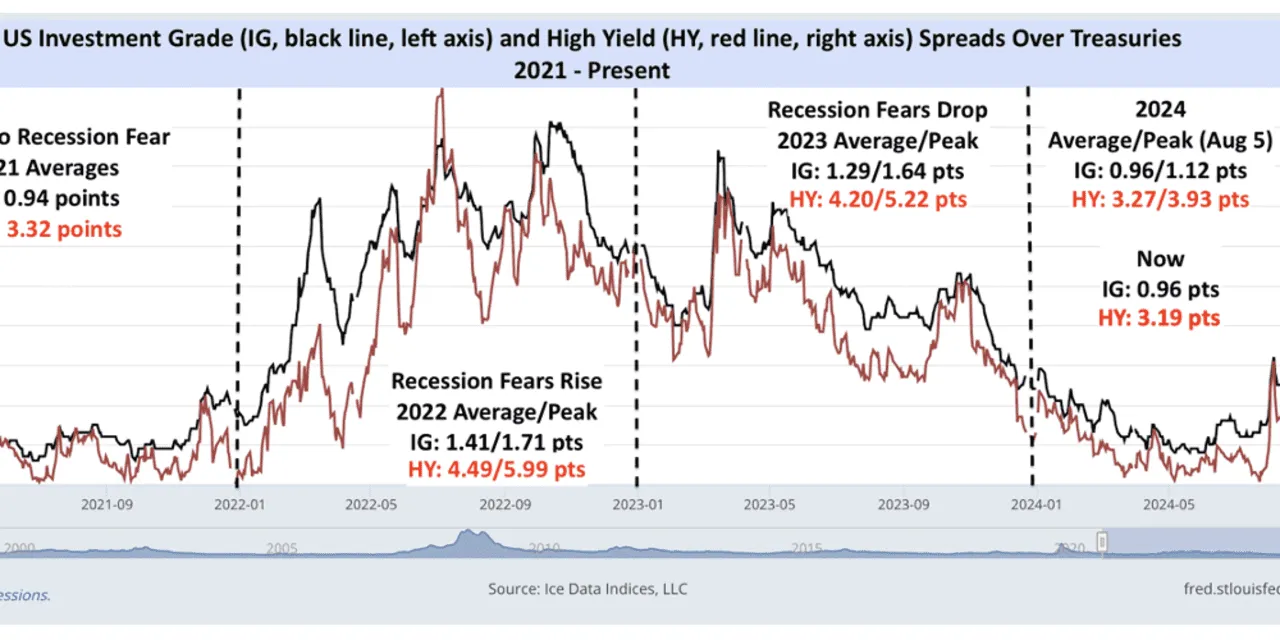

Corporate bonds show excessive optimism as investors remain sanguine about the economic outlook. These bonds have returned to levels that are roughly on par with their averages from 2021, following a brief spike earlier this month due to stock market sell-offs.

Market Response

- The decline in corporate bond spreads indicates a return of confidence among bond traders.

- This recovery signals that investors are less concerned about potential economic downturns.

According to DataTrek, this trend suggests that investor perception of the U.S. economy remains optimistic, at least in the near term. The interplay of market factors is critical for understanding future opportunities in financial markets.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.