Millions of Californians Face Medical Debt Impact as Proposed Rules Seek Credit Protection

The Rising Challenge of Medical Debt

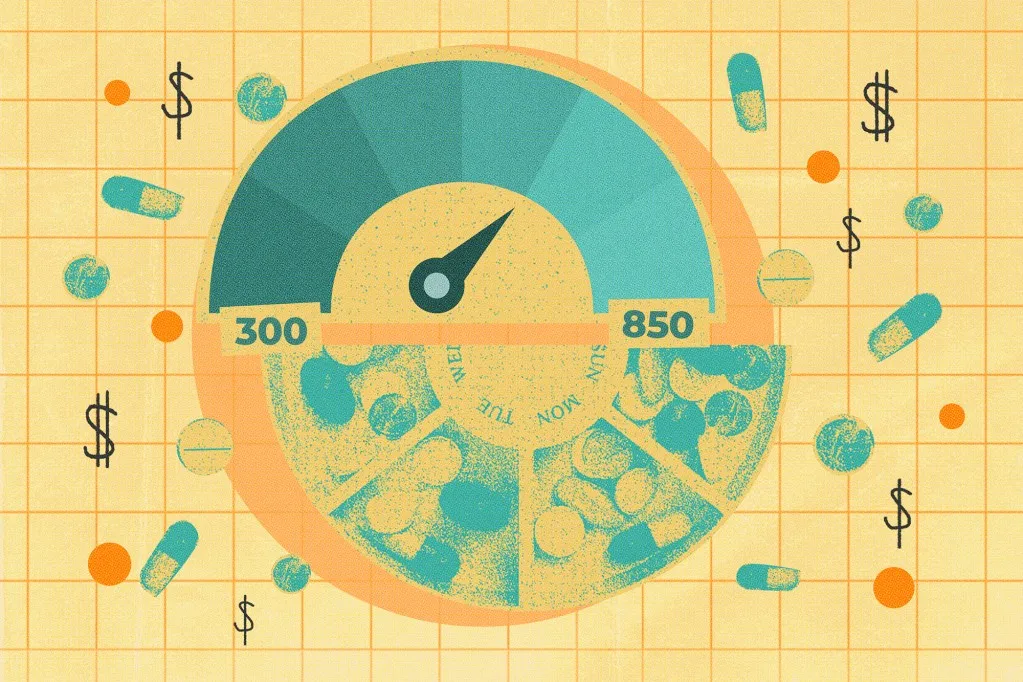

Millions of Californians grapple with the burdens of medical debt. This financial strain not only affects health but also dings credit scores, hampering opportunities for loans and credit. The proposed rules could potentially mitigate these effects significantly.

Proposed Changes to Protect Credit Scores

Under the new framework, medical debt will be less likely to appear on credit reports, offering significant relief for affected individuals. This adjustment aims to change the narrative surrounding medical obligations and creditworthiness.

Understanding the Implications

- Consumers may benefit:

- Credit scores could improve for many

- Access to credit might become easier

It is essential for consumers to stay informed about these developments. This proposed rule could impact millions of lives positively.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.