Bitcoin Mining Strategy Analysis: MicroStrategy and the Debt Dilemma

Understanding Bitcoin Mining and Financial Strategies

In the world of bitcoin mining, the methods adopted by leading companies can significantly impact their success. MicroStrategy has set the stage with strategies aimed at alleviating debt pressures while maximizing profitability. Leading miners such as Marathon Digital (MARA) have informed their decisions based on analysis of these strategies.

Marathon Digital’s Approach to BTC Acquisition

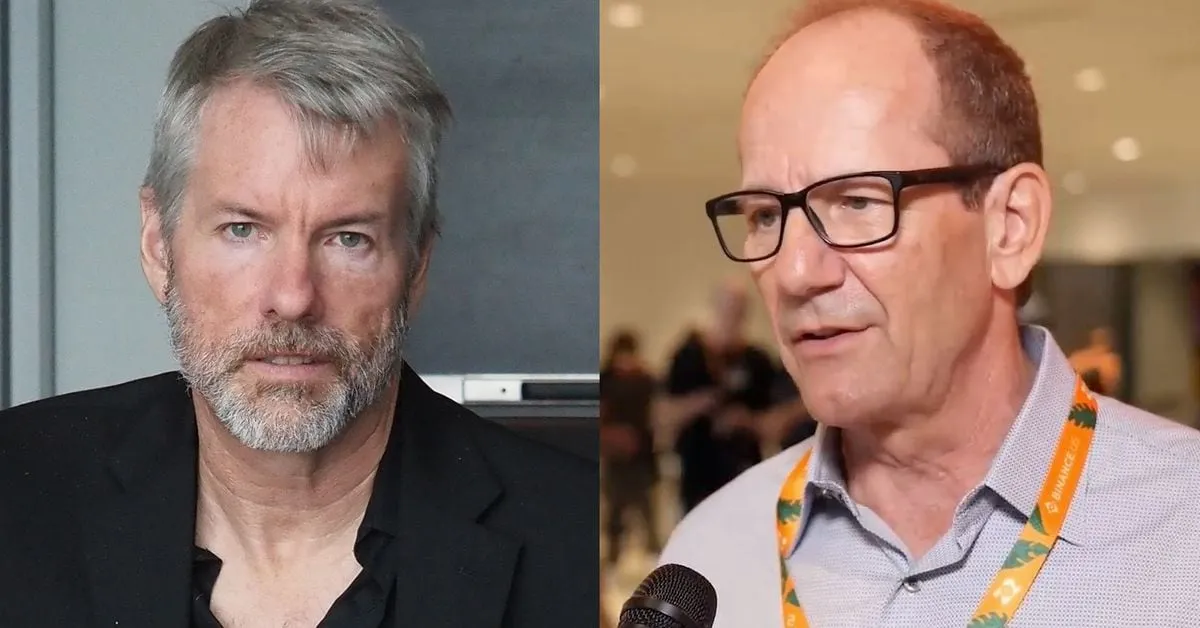

Marathon Digital has taken the bold step of buying bitcoin directly from the open market, rather than solely relying on mined resources. This strategic pivot is a direct response to the ongoing economic pressures within the mining sector. By looking to Michael Saylor's methods, MARA aims to fortify its position in a volatile market.

Key Insights from Michael Saylor’s Strategy

- Long-term holds: Emphasizing the significance of holding BTC.

- Debt management: Strategic acquisition of assets amidst debt obligations.

- Market adaptability: Adjusting approaches based on real-time market conditions.

These insights are crucial for companies as they navigate the harsh realities of bitcoin mining and the associated financial pressures.

The Future of Bitcoin Mining

The path ahead for bitcoin mining is uncertain, particularly for firms like MicroStrategy and Marathon Digital. Their ability to adapt and implement successful strategies, such as those propagated by Saylor, will be significant in determining their future within this dynamic sector.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.