Analysis of Coastal Home Ownership Model and Its Implications on Property Values

Impact of Policy and Market Forces on Coastal Real Estate Prices in the US

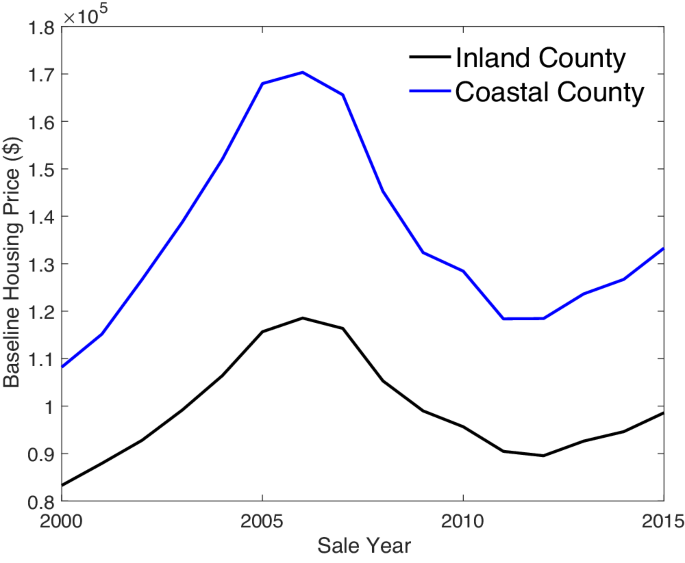

Despite increasing risks from sea-level rise (SLR) and storms, US coastal communities continue to attract relatively high-income residents, and coastal property values continue to rise. To understand this seeming paradox and explore policy responses, we develop the Coastal Home Ownership Model (C-HOM) and analyze the long-term evolution of coastal real estate markets. C-HOM incorporates changing physical attributes of the coast, economic values of these attributes, and dynamic risks associated with storms and flooding. Resident owners, renters, and non-resident investors jointly determine coastal property values and the policy choices that influence the physical evolution of the coast. In the coupled system, we find that subsidies for coastal management, such as beach nourishment, tax advantages for high-income property owners, and stable or increasing property values outside the coastal zone all dampen the effects of SLR on coastal property values. The effects, however, are temporary and only delay precipitous declines as total inundation approaches. By removing subsidies, prices would more accurately reflect risks from SLR but also trigger more coastal gentrification, as relatively high-income owners enter the market and self-finance nourishment. Our results suggest a policy tradeoff between slowing demographic transitions in coastal communities and allowing property markets to adjust smoothly to risks from climate change. Subsidies for coastal management and tax advantages for high-income property owners dampen the negative effects of climate risks on coastal property values. Without subsidies or tax advantages market prices better reflect climate risks, but coastal gentrification could accelerate.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.