Bitcoin ETFs Surge with $250M Net Inflows Following Jackson Hole Rate Cut Signal

Recent Trends in Bitcoin ETF Investment

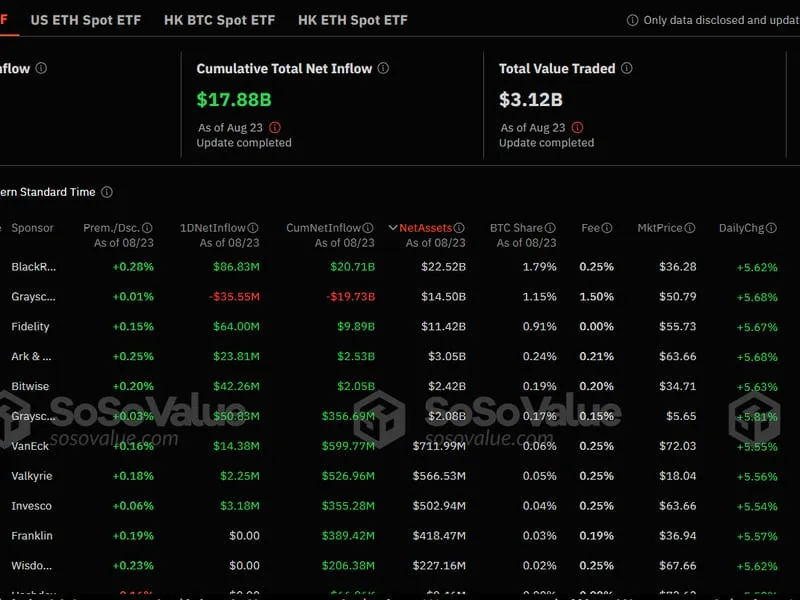

Bitcoin ETFs have seen remarkable activity recently, logging $250 million in net inflows. This surge is attributed to a positive outlook regarding potential rate cuts following the Jackson Hole symposium.

Trading Volumes Soar

- U.S.-listed spot bitcoin ETFs reported trading volumes exceeding $3.12 billion.

- This is the highest level of interest since July, showing renewed investor enthusiasm.

Market Implications

The market reaction reflects a significant shift in investor sentiment as rate adjustments could influence the wider financial landscape. The potential for more favorable economic conditions increases investor interest in crypto assets.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.