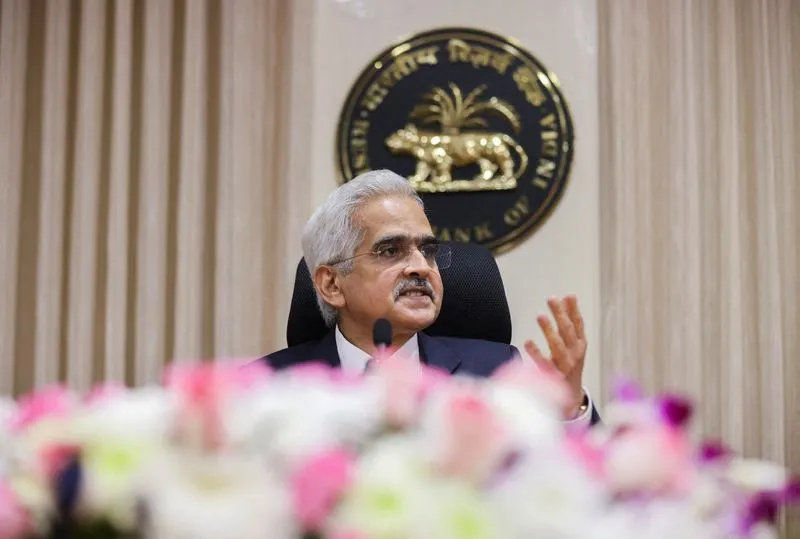

India to Launch Platform for Rural and Small Business Lending, Says Cenbank Governor

India's Commitment to Rural Lending

In an announcement, the cenbank governor revealed that India will be introducing a new platform aimed at facilitating credit for rural and small businesses. This initiative responds to the significant unmet demand for loans within the agricultural sector and among small enterprises.

Addressing Credit Gaps

- Targeting Underserved Markets: The platform focuses on providing access to credit for those who have faced barriers in traditional lending.

- Enhancing Financial Inclusion: By catering to rural and small businesses, it aims to foster growth and stability within local economies.

- Expected to launch amid broader economic initiatives designed to stimulate growth.

This strategic move underlines the importance of empowering small businesses and enhancing overall economic resilience.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.