Maximizing Insights from JM Smucker's (SJM) Q1 2025 Earnings Report

Overview of JM Smucker's Q1 2025 Earnings Expectations

Shares of The J.M. Smucker Co. (NYSE: SJM) have remained strong, gaining over 11% in the past three months. The company is poised to report its first quarter 2025 earnings results on Wednesday, August 28, before market open. Here's a breakdown of expectations:

Revenue Projections

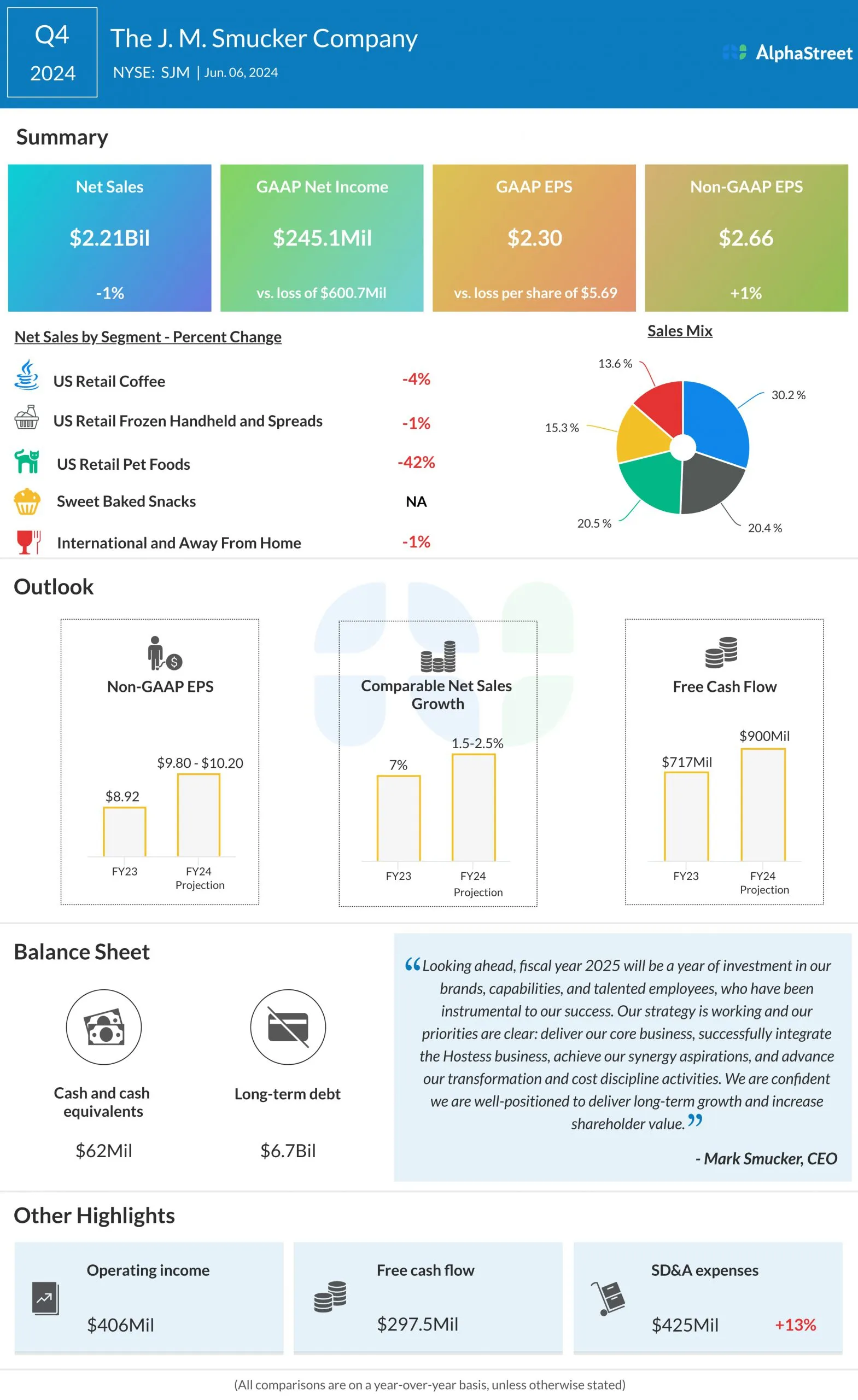

JM Smucker anticipates net sales for Q1 2025 to rise by a high-teen percentage, primarily due to contributions from the Hostess Brands acquisition and favorable volume growth. Analysts predict sales to reach $2.13 billion, a significant increase from $1.80 billion reported in the same quarter last year. Previous quarter sales had dipped by 1% year-over-year.

Expected Earnings

SJM is forecasting a slight decline in Q1 2025 adjusted EPS, impacted by rising selling and administrative expenses. Analyst estimates suggest EPS will hit $2.17, slightly lower than the $2.21 adjusted EPS from Q1 2024. The prior quarter saw a modest 1% YoY EPS increase.

Key Highlights

- Demand for branded products is anticipated to support growth.

- Acquisition of Hostess Brands enhances SJM's product portfolio.

- Expected increase in green coffee costs projected for Q1 2025.

- Strength in Uncrustables brand with 17% sales growth forecasted.

- Competition remains strong for Jif peanut butter against private label brands.

- Pet Foods segment shows positive momentum with Milk-Bone and Meow Mix brands.

- Sweet Baked Snacks category should contribute to Q1 success.

- Anticipated continuation of lower costs and favorable pricing in gross profit.

For more comprehensive insights, please stay tuned for the full coverage of JM Smucker's (SJM) Q1 earnings results.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.