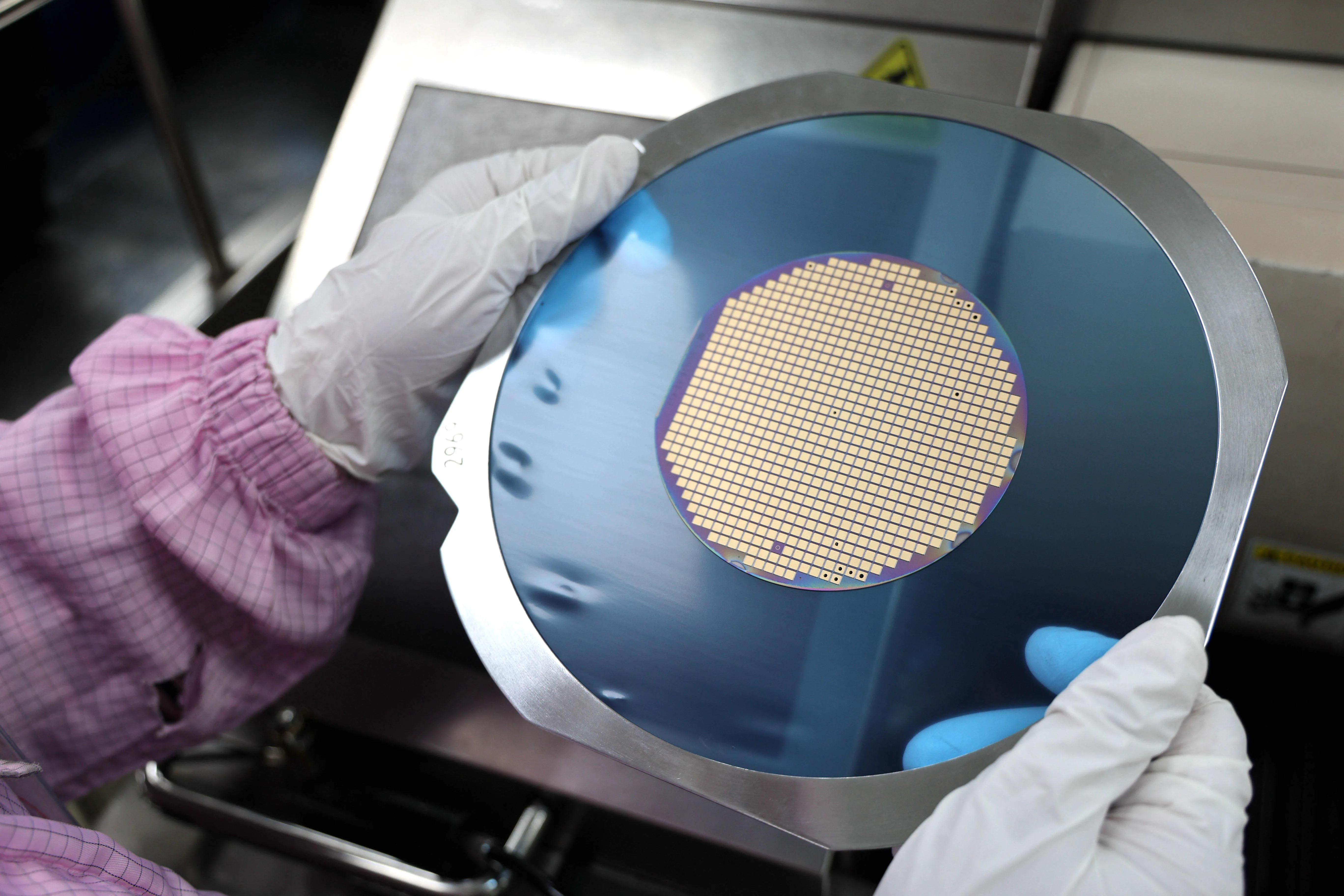

Don't Be Scared by Chip Stock Volatility: Investment Strategies for Qualcomm Inc, Western Digital Corp, and More

Investment Strategies Amid Chip Stock Volatility

The ongoing fluctuations in the semiconductor sector shouldn't deter savvy investors. Qualcomm Inc, Western Digital Corp, and ASML Holding NV exemplify resilient stocks worthy of your portfolio. Investors should consider the following strategies:

- Monitor economic indicators affecting semiconductor demand.

- Evaluate performance metrics of key players in the industry.

- Stay informed about NVIDIA Corp, Micron Technology Inc, and their impact on market movements.

Why Buy Chip Stocks Now?

Despite current market fluctuations, chip stocks like Broadcom Inc show potential for strong returns. Analysts suggest that staying the course with these investments can yield significant gains.

For those exploring investments in semiconductors, the Phlx Semiconductor Sector Index serves as a valuable resource for assessing market trends.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.