Stocks and Bonds Relationship Reverts to Historic Trends

Historical Inversion of Stocks and Bonds

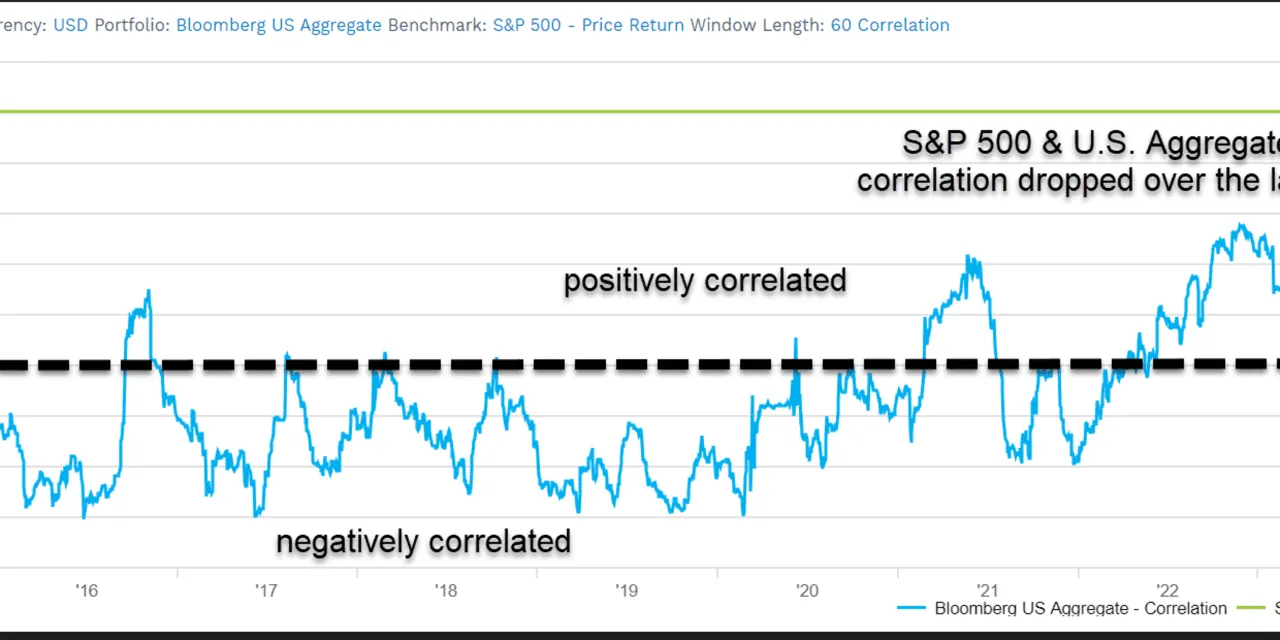

Stocks and bonds have traditionally held an inverse relationship. In periods of declining equity prices, fixed income often stabilizes a portfolio.

Recent Disruption

Recently, high inflation and an era of low rates challenged this trend. As the Federal Reserve increased rates to combat inflation, both asset classes faced significant declines.

Data and Insights

Emily Roland and Matt Miskin, co-chief investment strategists at John Hancock Investment Management, analyzed rolling 60-day correlations between the S&P 500 index and the U.S. Aggregate bond index, revealing signs of a rebound in traditional behaviors.

Conclusion of Analysis

As the correlation shifts back, investors may want to consider reevaluating their approaches to asset allocation strategies.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.