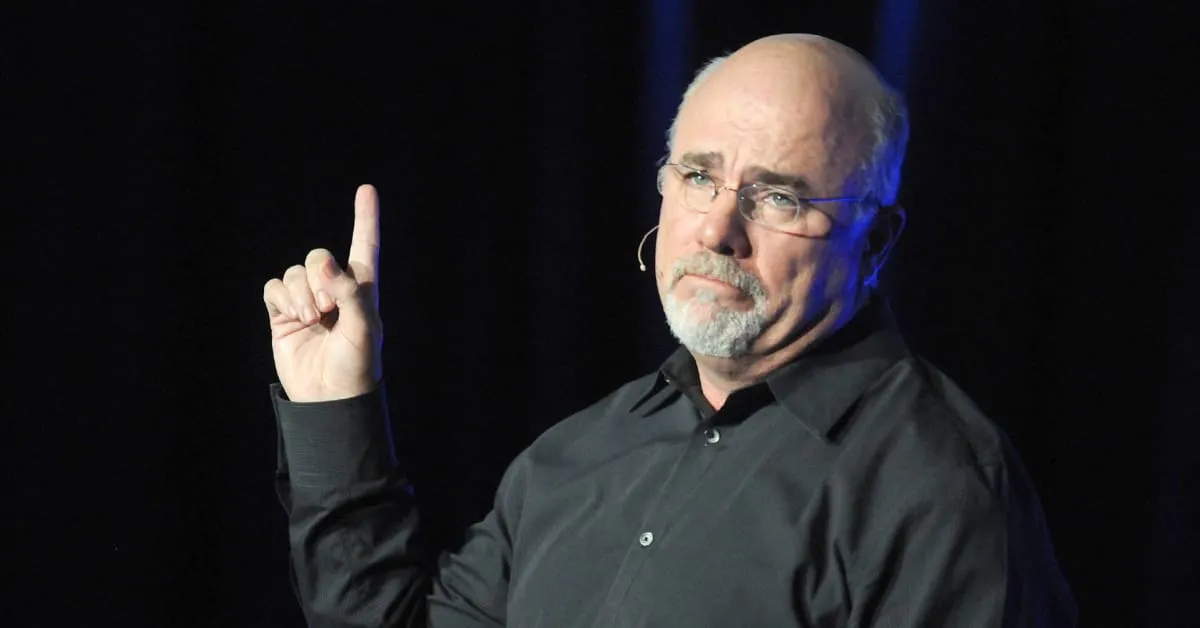

Investing Insights: Dave Ramsey on Retirement, Social Security, and 401(k)s

Dave Ramsey's Perspective on Retirement Planning

In today's financial landscape, investing has never been more critical. Dave Ramsey issues a wake-up call on the readiness for retirement amidst uncertainties surrounding Social Security. Many are left questioning their long-term financial strategies, particularly concerning 401(k)s and Roth IRAs.

The Role of 401(k)s and Roth IRAs

According to Ramsey, 401(k)s serve as a fundamental component of retirement savings. He emphasizes that the choice between traditional IRAs and Roth IRAs can significantly impact your financial future. Investing wisely in these accounts is paramount.

Understanding Social Security Risks

Social Security's uncertain future raises alarms. Individuals must prepare financially to avoid reliance on government aid in retirement. Financial planning with the right investment strategies can help families protect their assets and income.

Financial Influencers and Their Impact

Financial influencers like Ramsey provide valuable insights on maneuvering through today's economic climate. Their advice on cultivating a robust retirement plan is crucial for those looking to secure their personal finance strategies.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.