Karis Kasarinlan Paolo D. Mendoza Discusses Yield Tracker Trends in Government Debt

Government Debt Yields Show Mixed Trends

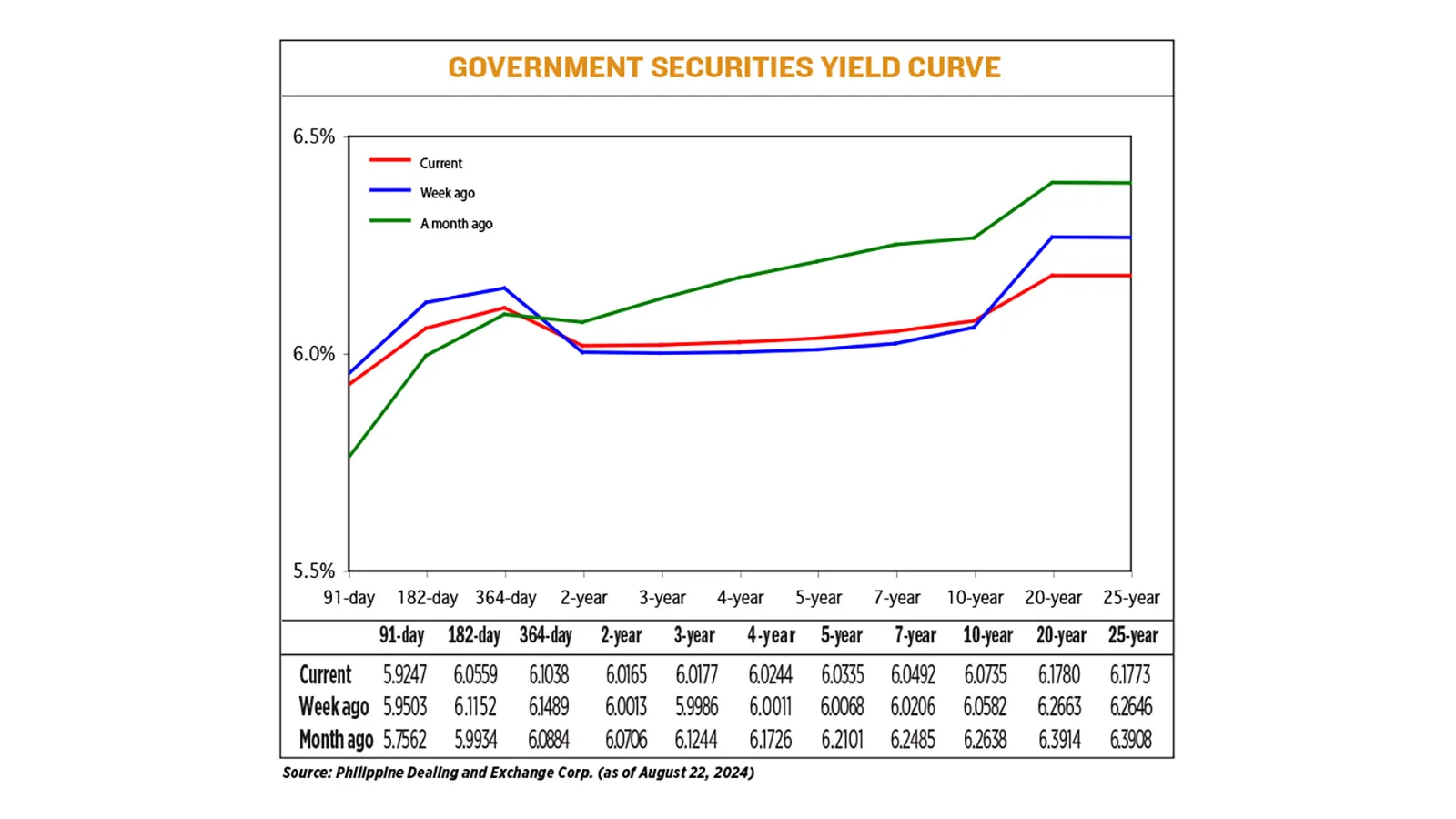

In recent weeks, yields on government securities have displayed a mixed pattern, driven by shifting expectations regarding upcoming rate cuts from the Bangko Sentral ng Pilipinas (BSP) and the US Federal Reserve.

Understanding the Yield Tracker Insights

The Yield Tracker, a financial tool utilized by investors, offers valuable information regarding these fluctuations. As yields are subject to change based on economic indicators and policy adjustments, investors are urged to remain vigilant.

Key Influences on Yields

- Rate Cut Expectations - Anticipation of lower rates can lead to altered investment decisions.

- Mixed Yield Outcomes - Recent movements in yields reflect the uncertainty in the financial environment.

- Global Economic Factors - Global market trends play a pivotal role in influencing local yields.

The financial landscape remains dynamic, and the Yield Tracker serves as a crucial resource for understanding these shifts.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.