Understanding the Unified Pension Scheme and Its Features for Government Employees

Overview of the Unified Pension Scheme

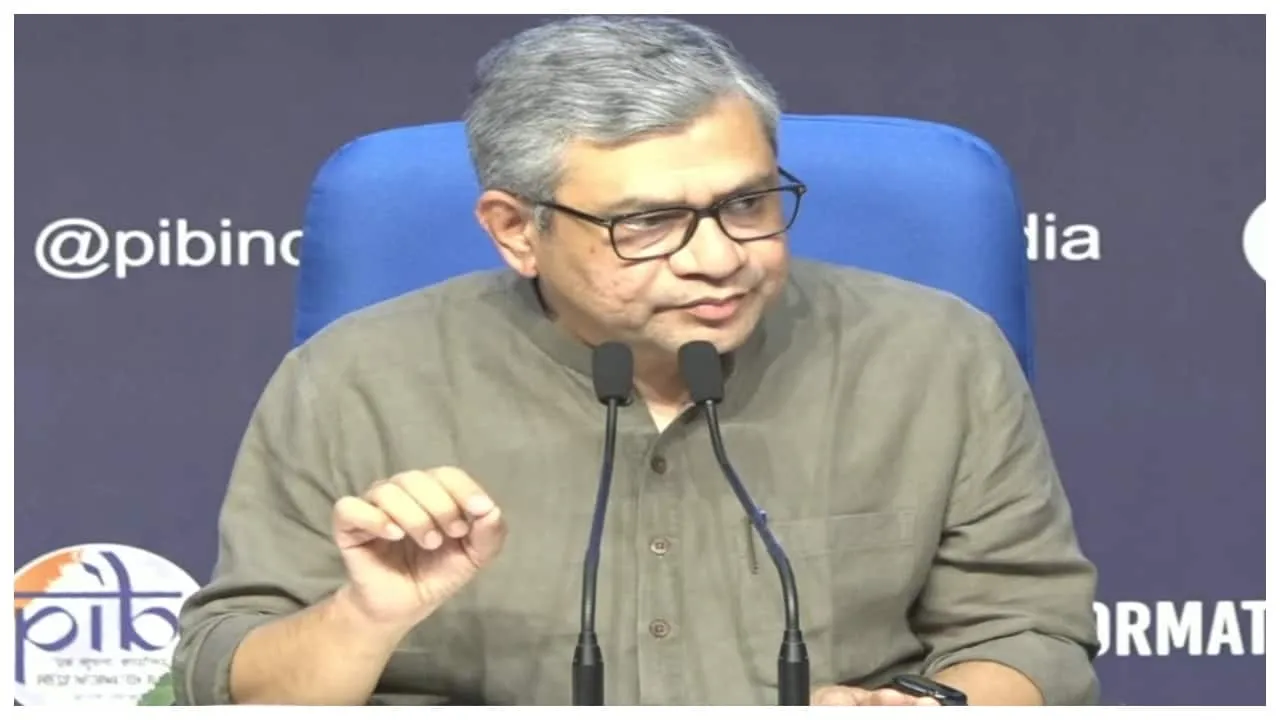

The Union Cabinet, chaired by Prime Minister Narendra Modi, has recently approved the Unified Pension Scheme (UPS) for government employees, aiming to provide assured pensions for approximately 23 lakh beneficiaries.

Key Features of the Unified Pension Scheme

- The pension is based on 50 percent of the average basic pay drawn in the last 12 months before retirement.

- A minimum qualifying service of 25 years is required to receive the full benefits, with proportional pensions available for shorter service periods.

- Beneficiaries with at least 10 years of service will receive a guaranteed minimum pension of Rs 10,000 per month.

- In the event of demise, a family pension of 60 percent of the employee’s pension will be offered.

Inflation Indexation and Additional Benefits

The assured pension, assured family pension, and the assured minimum pension will include inflation indexation. Benefits will align with the All India Consumer Price Index for Industrial Workers (AICPI-IW), ensuring that the pensions remain relevant against the backdrop of inflation.

Moreover, there will be a lumpsum payment at the time of superannuation, along with gratuity. This will include one-tenth of the monthly emolument (salary plus dearness allowance) for every completed six months of service.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.