Government Budget Impact: Harris’ Unrealized Capital Gains Tax Proposal

Government Finance and Taxation Overview

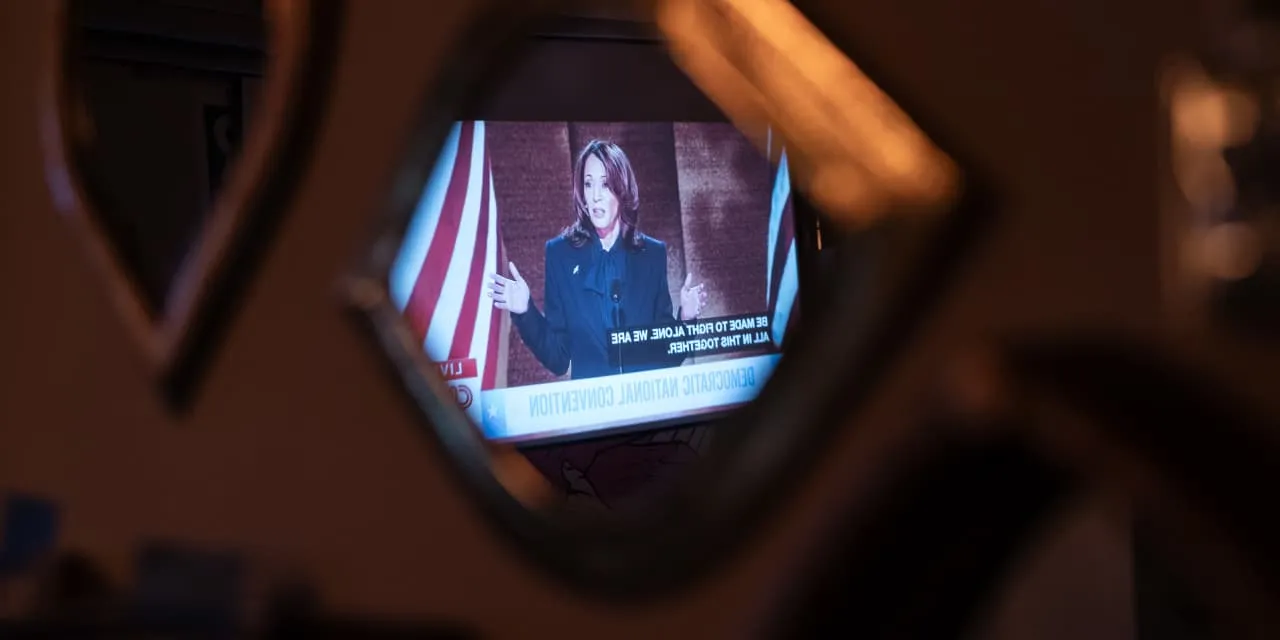

The recent buzz surrounding Harris’ unrealized capital gains tax proposal for the wealthiest Americans has raised eyebrows nationwide. This government budget initiative aims to address taxation effectively and equitably.

Understanding the Proposal

Harris proposes imposing taxes on unrealized capital gains, a concept that could shift how taxation is approached. This plan exclusively targets the wealthiest, which has led to concerns regarding fairness and economic news implications.

Economic and Political Implications

- Economic News: This tax could generate significant revenue for government finance.

- Direct Taxation: How this affects overall taxation policies remains a key issue.

- Political Reactions: The proposal has polarized opinions across political lines.

Future Economic Landscape

- Potential Revenue Generation for government budgets.

- Impact on Investments: Wealth management strategies may need reevaluation.

- Domestic Politics: Could influence upcoming elections significantly.

As debates unfold, staying informed through economic news is essential for understanding the ramifications of such policies.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.