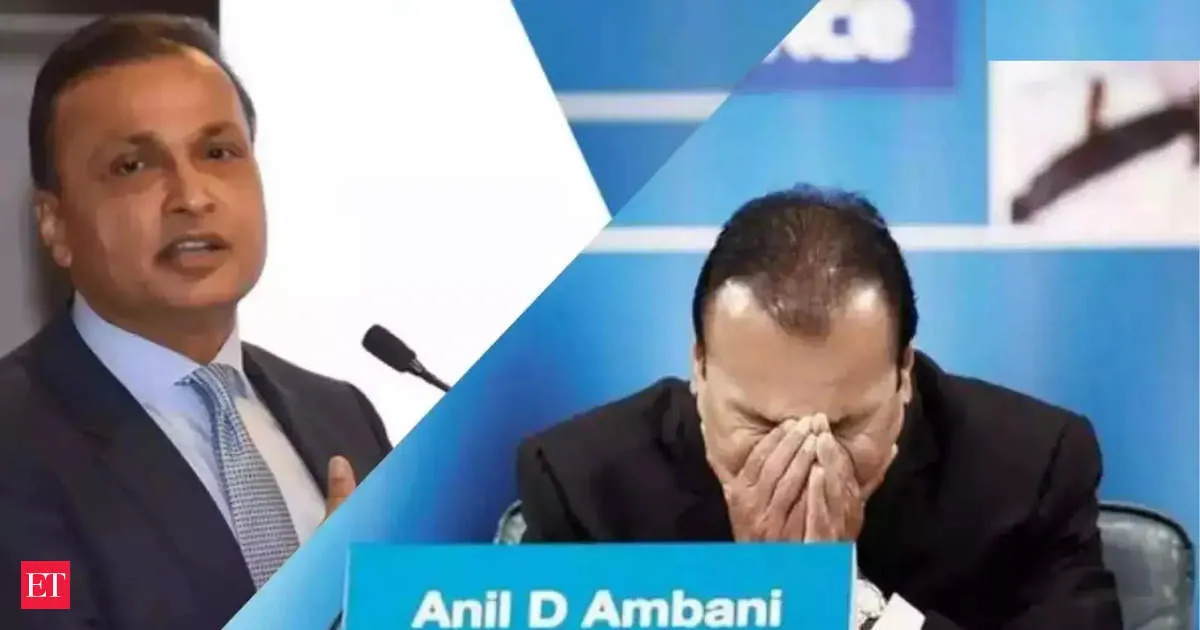

Anil Ambani Banned by Sebi: Impact on Reliance Home Finance and Investors

Why Sebi Banned Anil Ambani?

The Securities and Exchange Board of India (Sebi) has barred Anil Ambani, the former chairman of Reliance Home Finance (RHFL), and 24 other entities from the securities market for five years. This decision follows allegations of fund diversion from RHFL, where Ambani and key officials allegedly orchestrated a fraudulent scheme.

Sebi's Findings in Anil Ambani Case

Sebi's investigation revealed that Anil Ambani, aided by managerial personnel at RHFL, siphoned off funds disguised as loans to entities connected to him. Despite directives from the RHFL Board to cease such practices, the management disregarded these orders, resulting in a major governance failure.

Impact on RHFL and Shareholders

- The fraudulent activities caused RHFL to default on its debt obligations, leading to a resolution under the RBI Framework.

- Public shareholders faced substantial losses as the company's share price plummeted from Rs 59.60 in March 2018 to just Rs 0.75 by March 2020.

- Currently, over 9 lakh shareholders bear the consequences of this financial misconduct.

Sebi Imposes Fine on Anil Ambani and Others

Sebi has imposed fines not just on Anil Ambani but also on other former key officials of RHFL, including Amit Bapna, Ravindra Sudhalkar, and Pinkesh R Shah. Additionally, several entities linked to the Reliance group were penalized for their involvement in the illegal diversion of funds from RHFL.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.