Bitcoin Tops $61K: Implications of Jackson Hole and Ether ETFs Outflow

Bitcoin Surges to New Heights

Bitcoin reached a remarkable milestone, topping $61K right as the Jackson Hole symposium approaches. This surge signals a potential shift in market trends, captivating investor interest.

The Role of Jackson Hole

The annual Jackson Hole meeting often influences monetary policy perceptions. As Federal Reserve officials gather, market participants remain keenly aware of potential insights regarding interest rates and economic projections.

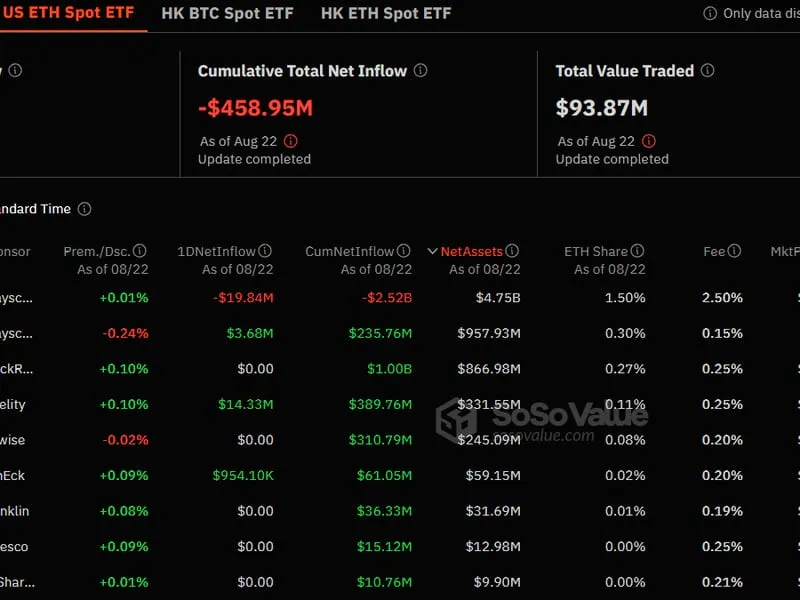

Record Outflows for Ether ETFs

Simultaneously, the Ether ETFs are experiencing a noteworthy trend, facing extended outflows. This downturn may reflect changing investor sentiments regarding Ethereum amid the broader market dynamics.

ETF Market Dynamics

- Spot Bitcoin ETFs recorded a significant $64 million in inflows.

- BlackRock's IBIT ETF led the charge, attracting the highest inflows at $75 million.

- The sustained influx into Bitcoin ETFs contrasts sharply with Ether's performance.

Impact on Investment Strategies

These developments underscore critical shifts in crypto investment strategies, suggesting that investors are reassessing their positions in light of emerging trends.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.