Business Inflation and Interest Rates: What Powell’s Address Means for U.S. News

Understanding Business Inflation Effects

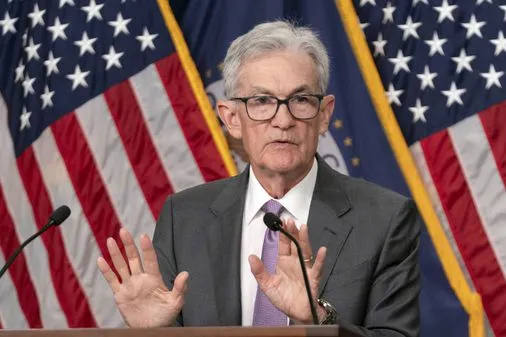

As business inflation continues to shape market dynamics, many anticipate that Fed Chair Jerome Powell will shed light on future interest rates during his forthcoming speech. Speculation abounds as the Federal Reserve is expected to initiate rate cuts soon, which could significantly influence Washington news.

Significance of Powell's Speech

This address is pivotal for those monitoring U.S. news regarding economic recovery strategies. Analysts argue that Powell’s statements may signal a shift in monetary policy that could affect spending and investment across sectors. Key points include:

- Market Reactions: Stocks may react favorably if interest rates decrease.

- Long-term effects: Continuous inflation could alter recovery forecasts.

- Investor Sentiment: Reassurance from the Fed may bolster confidence.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.