Why Intuitive Surgical's Valuation May Be Too High (NASDAQ:ISRG)

Understanding Intuitive Surgical's Valuation Concerns

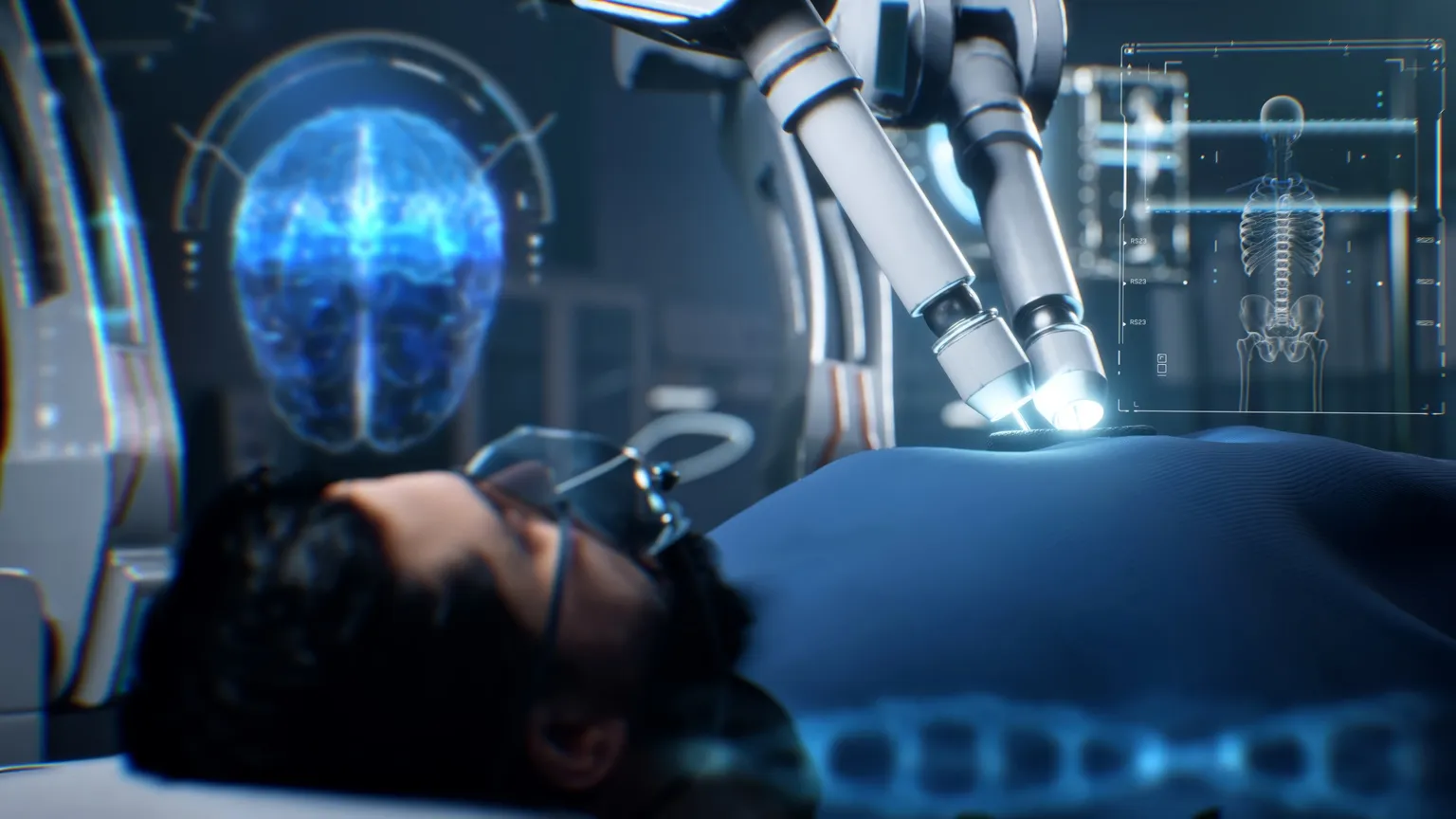

As we analyze Intuitive Surgical, the discussion centers on whether its valuation reflects reality or inflation. The company's track record is impressive, but with soaring stock prices, investors must question if the figures are justified.

Growth Trajectory Versus Valuation

- Margin of Safety: Investors often seek a margin of safety, and this is where ISRG may falter.

- Stock Performance: Despite growth, the inflated valuation could pose risks.

- Market Trends: Ongoing market trends affect the durability of such valuations.

Conclusion on Investment Strategy

Current conditions require cautious evaluation. Investors need to remain vigilant about the actual performance metrics versus market expectations. Assessing Intuitive Surgical's viability as a potential investment is crucial for securing future gains.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.