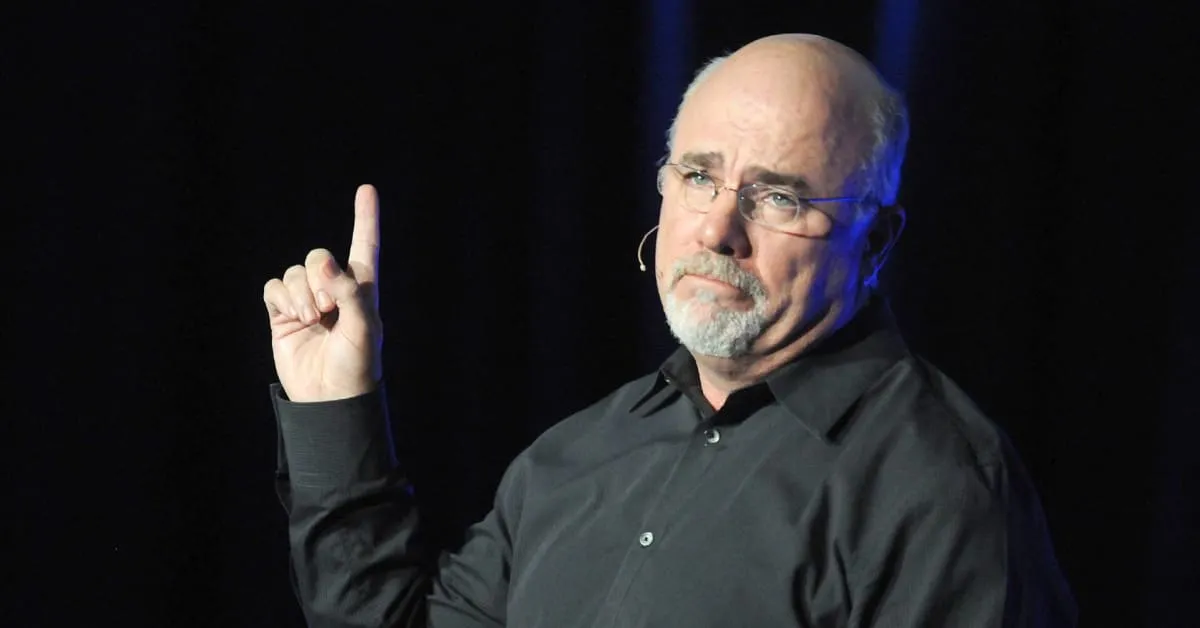

Dave Ramsey Explains the Role of Credit Cards and Financial Influencers in Personal Finance

Embracing Financial Planning for Stability

Americans are battling untenable levels of debt, and many face a shaky financial future. Experts agree that paying down credit card debt is crucial for financial wellness. Dave Ramsey, a prominent voice in personal finance, emphasizes the significance of responsible money management.

The Impact of Financial Influencers

With the rise of financial influencers, individuals often seek guidance from various sources. While many provide useful insights, Ramsey cautions against relying solely on social media for financial advice. He believes a solid understanding of personal finance is essential for success.

Debt Management Strategies

Ramsey promotes several approaches to debt management, including:

- Creating a strict budget

- Prioritizing debt repayment

- Avoiding new credit card debt

By implementing these strategies, Americans can work towards a debt-free future.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.