Mortgage Rates Dip Again Near Historical Lows – August 2024 Update

Current Trends in Mortgage Rates

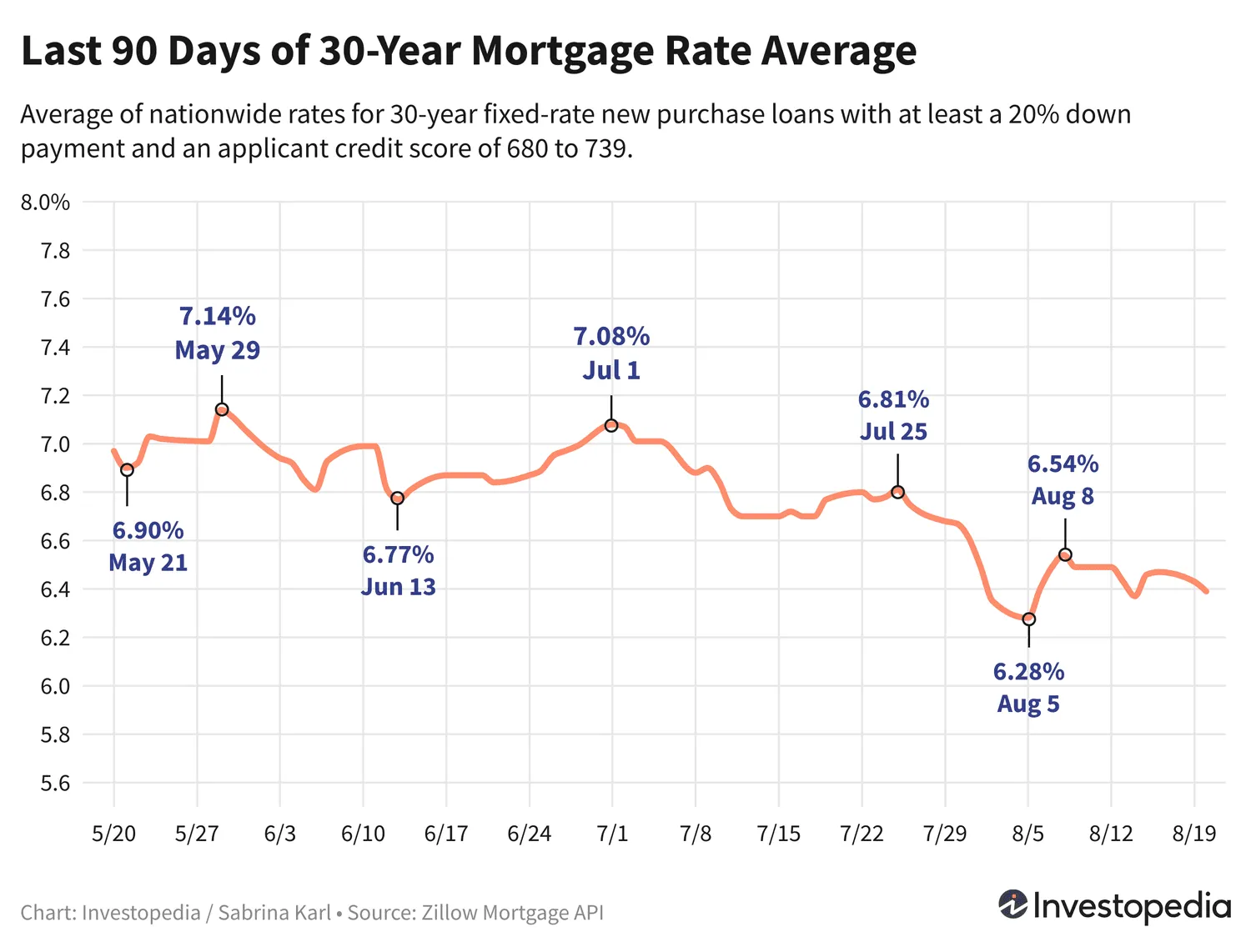

Mortgage rates dip again, reflecting a significant drop towards their 16-month low. After hitting a low not seen since April 2023, the 30-year mortgage rate initially rose but has recently resumed its descent. This shift presents notable opportunities for homebuyers looking to secure financing at more favorable rates.

Market Analysis

As the market breathes a sigh of relief with mortgage rates dipping, several factors play a role:

- Economic Indicators: Inflation rates are stabilizing, impacting overall borrowing costs.

- Central Bank Policies: Decisions by the Federal Reserve continue to influence rates.

- Consumer Demand: There is a noticeable uptick in homebuyer interest as finance becomes more accessible.

What It Means for Homebuyers

With mortgage rates dipping again, potential homebuyers are advised to evaluate their options diligently. This favorable environment could mean:

- Lower monthly payments.

- Increased home affordability.

- Potentially longer loan terms at competitive rates.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.