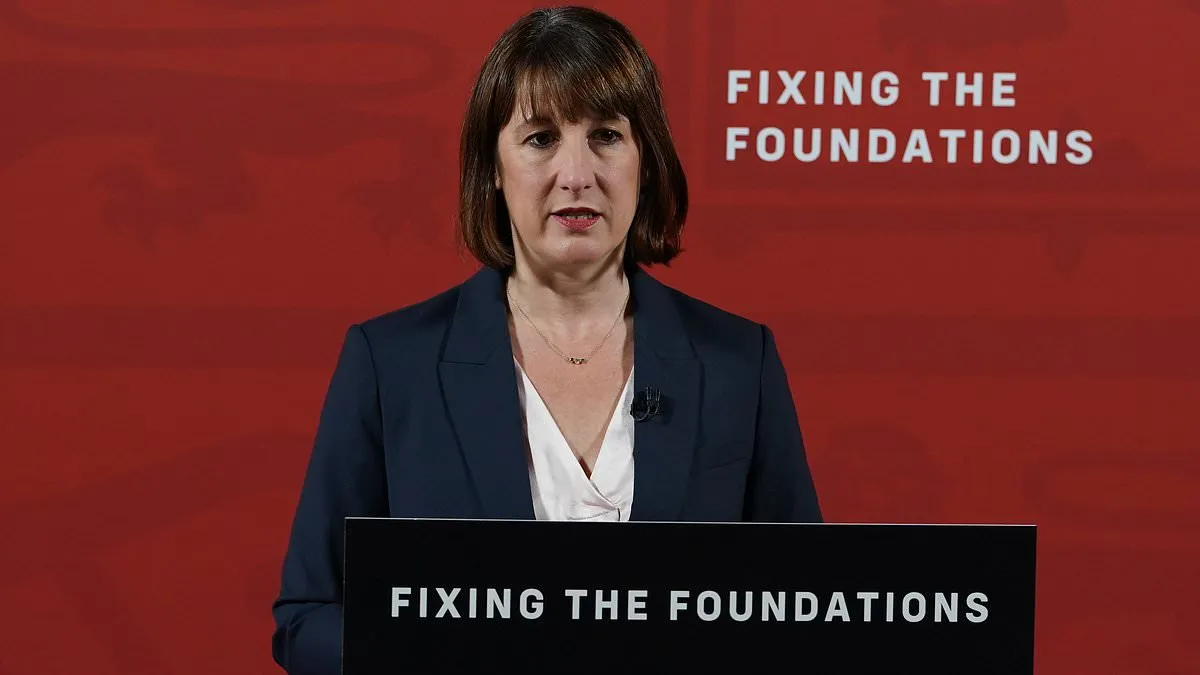

DailyMail Money Markets: The Implications of Rachel Reeves' Proposed Tax Hikes

Exploring Rachel Reeves' Halloween Tax Hikes

DailyMail money markets indicate that Rachel Reeves now possesses the ideal justification for enforcing tax increases during October's Budget. The staggering £3 billion surge in government borrowing last month, attributed to substantial public sector pay rises, raises concerns over potential economic instability.

Impact on the Economy

As these tax hikes loom, experts warn of potential outcomes that could ripple throughout the economy. The upcoming measures might aggravate the financial burden on households and businesses alike. Moreover, increasing government spending amidst such a fiscal crisis leads to questions regarding sustainability.

- Public Resistance: Citizens may push back against higher taxes.

- Market Reactions: Investors might begin to reassess their positions in light of increased fiscal pressure.

- Long-term Consequences: The sustainability of such high borrowing levels is under scrutiny.

The fiscal landscape appears precarious, raising questions about the viability of such drastic measures. Stakeholders in money markets need to remain vigilant as this situation evolves.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.