Mortgage Rates Dip Again: What This Means for Homebuyers

Wednesday, 21 August 2024, 07:56

Impact of the Latest Mortgage Rate Changes

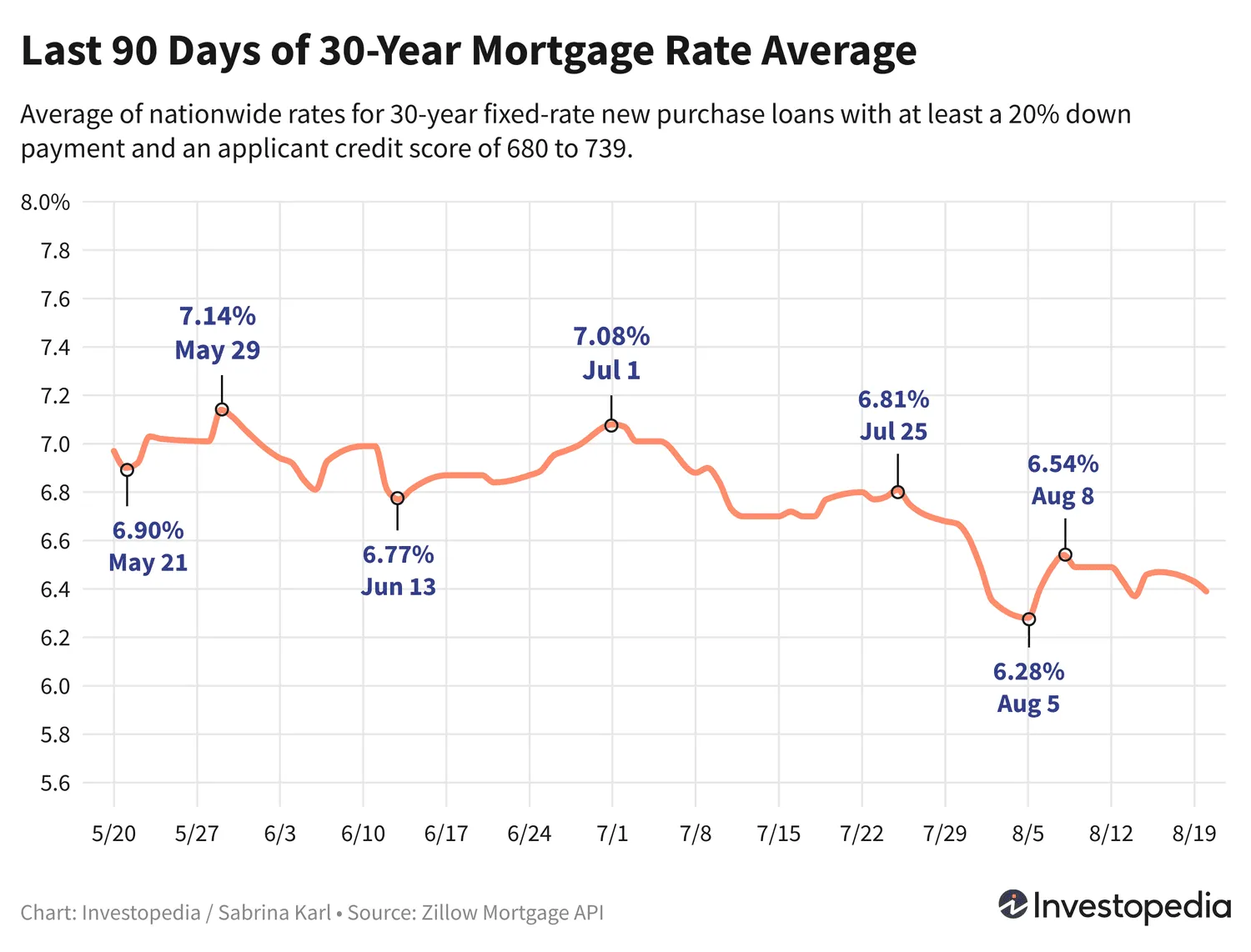

The recent dip in mortgage rates could significantly affect homebuyers looking to secure favorable financing options. With the 30-year mortgage rate average falling to levels not seen since April 2023, potential homeowners may find opportunities to purchase properties at more affordable monthly payments.

Reactions from Real Estate Experts

- Experts predict an increase in homebuyer activity as rates decrease.

- Lower rates often lead to higher demand in the housing market.

- Potential buyers should act quickly to capitalize on current rates.

Future Implications for the Housing Market

- Continued rate fluctuations may pose challenges for long-term predictions.

- Home values are likely to respond to changes in mortgage affordability.

- Monitoring economic factors is essential for future rate expectations.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.