Smartphones in Focus: China’s Rare Earth Elements Strategy Unveiled

Understanding China's Rare Earth Elements Policies

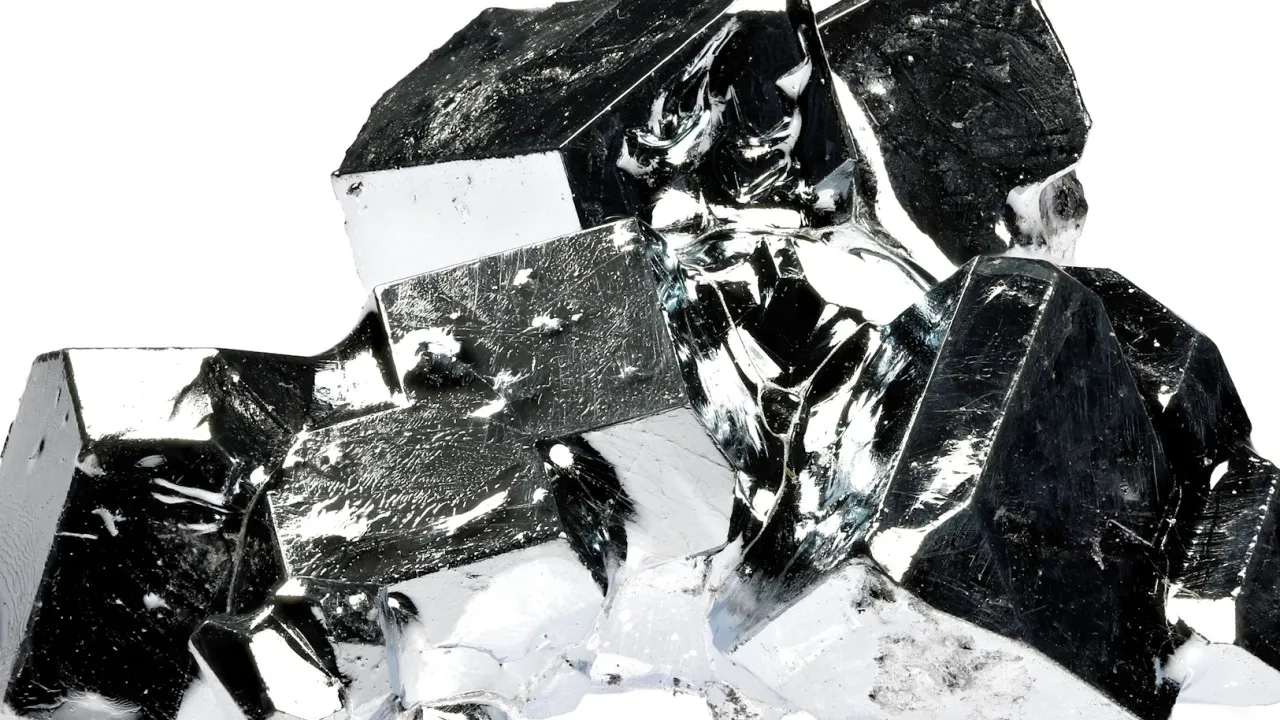

Smartphones rely heavily on rare earth elements, and recent actions by the Ministry of Natural Resources and Ministry of Industry and Information Technology suggest Beijing is looking to adjust its production quotas. The second batch for 2023 has set a production limit of 135,000 tonnes, the same as the previous figures. Such measures aim to stabilize prices amid rising global demands.

The Implications of Reduced Supply

With a projected 5.9% increase in production year-on-year, this might seem positive, but due to the absence of further batches, the anticipated growth rate is uncertain. According to a note from Topsperity Securities, narrowing the domestic supply could potentially result in price increases for rare earth elements, essential for industries like new-energy vehicles and wind-turbine sectors.

Global Market Dynamics

- China commands 70% of the world’s rare earth production by 2023.

- Falling prices—about 20% lower since the year began—pose a threat to market stability.

- Australia and other nations double down on developing their rare earth production capabilities.

China's commitment to restricting its output raises serious questions about its role in the global supply chain and the potential ramifications for technological frontrunners like the United States.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.