Investment Strategy: Analyzing the VIX Index and Its Impact on Stock Markets and Economic Events

Understanding the VIX Index and Stock Market Dynamics

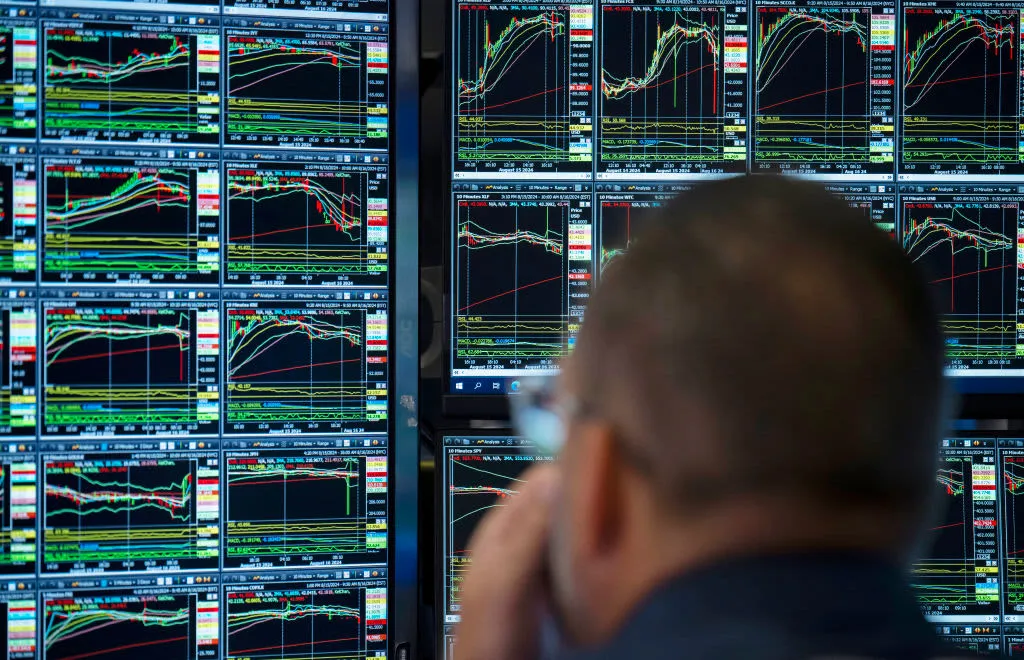

The VIX Index (Mar'21) is a significant measurement of market volatility, often referred to as the 'fear gauge.' As investors look for informative investment strategies, analyzing the VIX can provide insights into future movements of the S&P 500 Index.

Importance of Economic Events

- Economic events impact investor sentiment and market trends.

- Understanding the correlation between the VIX Index and stock markets is essential for effective investment strategies.

- Monitoring the VIX can guide decisions during uncertain periods.

Key Indicators for Investors

- Recognize that a rising VIX may suggest increased risk in markets.

- Use the VIX Index alongside other economic indicators for a comprehensive view.

- Adopt flexible investment strategies that adjust to changing market conditions influenced by the VIX.

Stay updated with business news surrounding the VIX Index and stock markets to refine your investment strategy.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.