Ovintiv Considers $2B Sale of Uinta Basin Oil to Focus on Permian Basin

Potential Sale of Uinta Basin Oil Operations

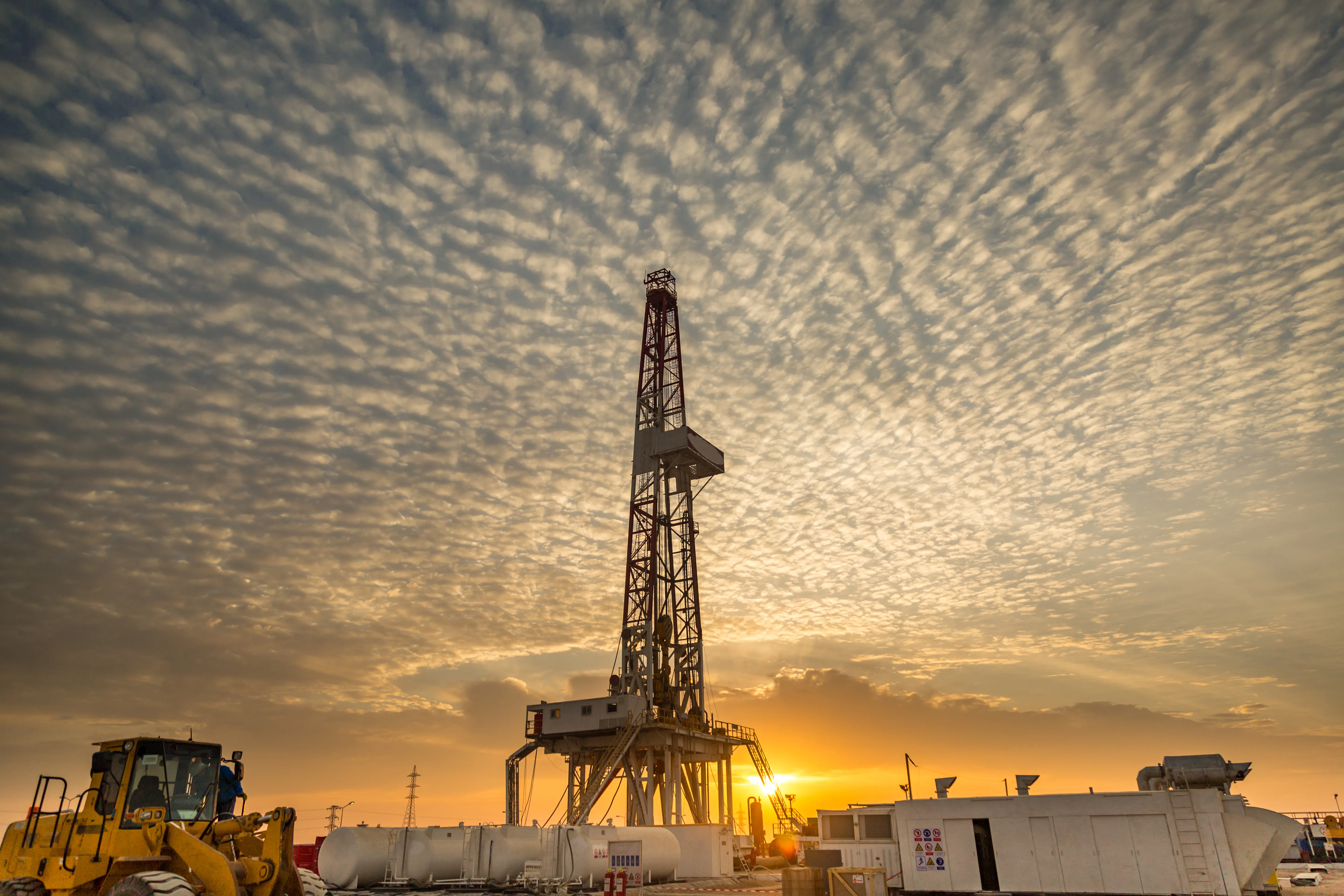

Ovintiv (NYSE:OVV) is contemplating a significant divestiture by selling its Uinta Basin operations for $2B. This step marks a strategic effort to redirect resources towards the North American Permian Basin, where the company aims to maximize production capacities and profitability.

Focus on Permian Basin Investments

After successfully expanding operations in the Permian Basin with a previous $4.3B acquisition, Ovintiv's potential sale reflects a shift in corporate strategy towards more lucrative operational areas. This sale could provide an essential influx of capital to further enhance its presence in the Permian region.

- Strategic Focus: Shifting priorities towards profitable regions.

- Market Response: Investor reaction to the outlined plan.

- Future Outlook: Implications for Ovintiv's growth trajectory.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.