Lowe's Q2 2024 Earnings: Analyzing the Home Improvement Retailer’s Mixed Results

Performance Overview

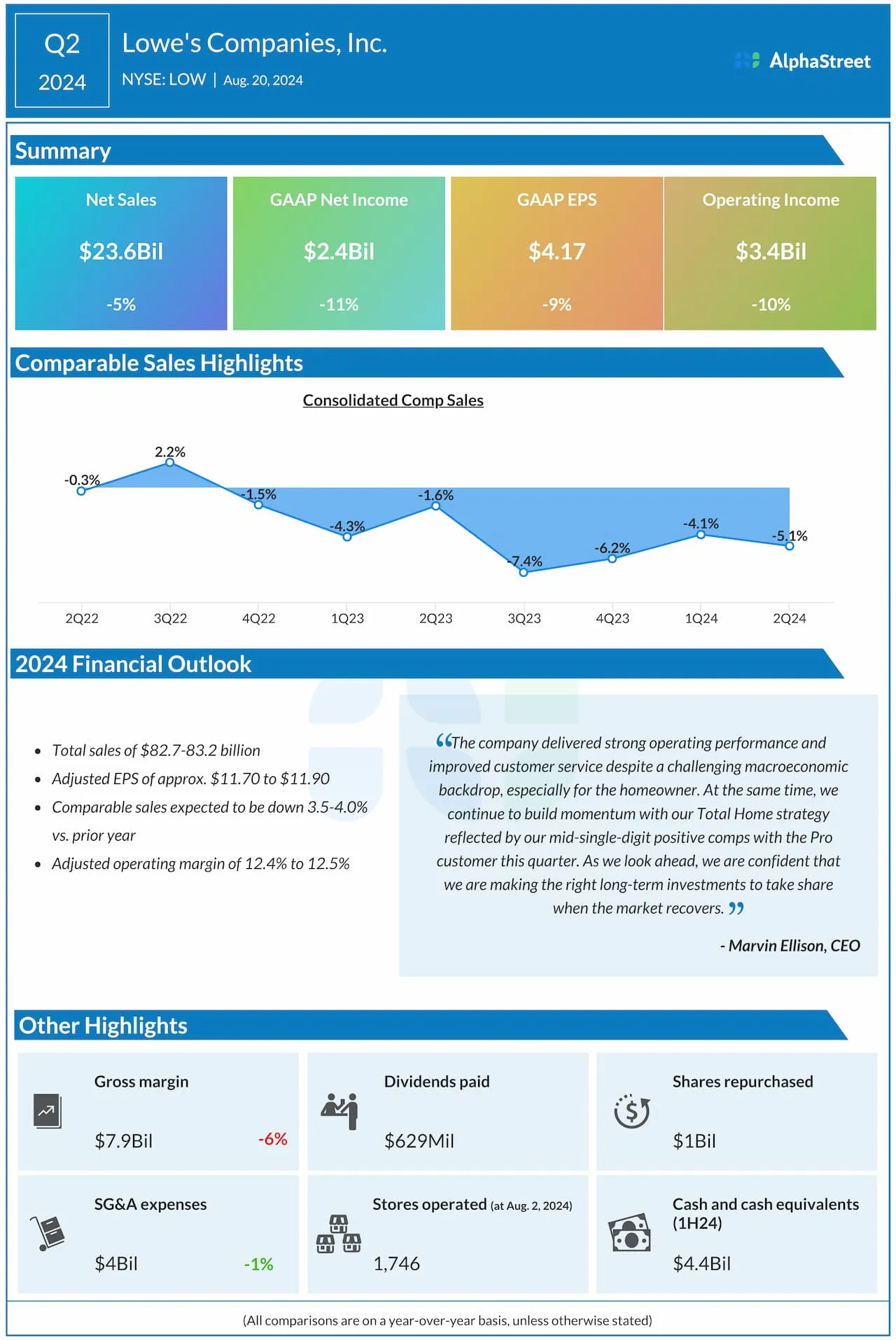

Lowe's Companies, Inc. (NYSE: LOW) reported a 5% decrease in net sales for Q2 2024, totaling $23.6 billion, which missed market expectations. Notably, comparable sales fell by 5.1% due to weakened DIY spending and unfavorable weather conditions impacting seasonal sales.

Key Takeaways

- GAAP EPS dropped 9% year-over-year to $4.17.

- Adjusted EPS reached $4.10, slightly surpassing projections.

- Pressure in DIY projects persists, while Pro segment shows resilience with mid-single-digit positive comps.

Guidance Cut Amid Economic Pressures

Due to ongoing challenges in the home improvement market, Lowe's has revised its full-year outlook for 2024. Expected total sales are now $82.7-83.2 billion, down from an initial forecast of $84-85 billion. Comparable sales are projected to decline between 3.5-4.0%, contrasting with previous estimates of 2-3%.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.