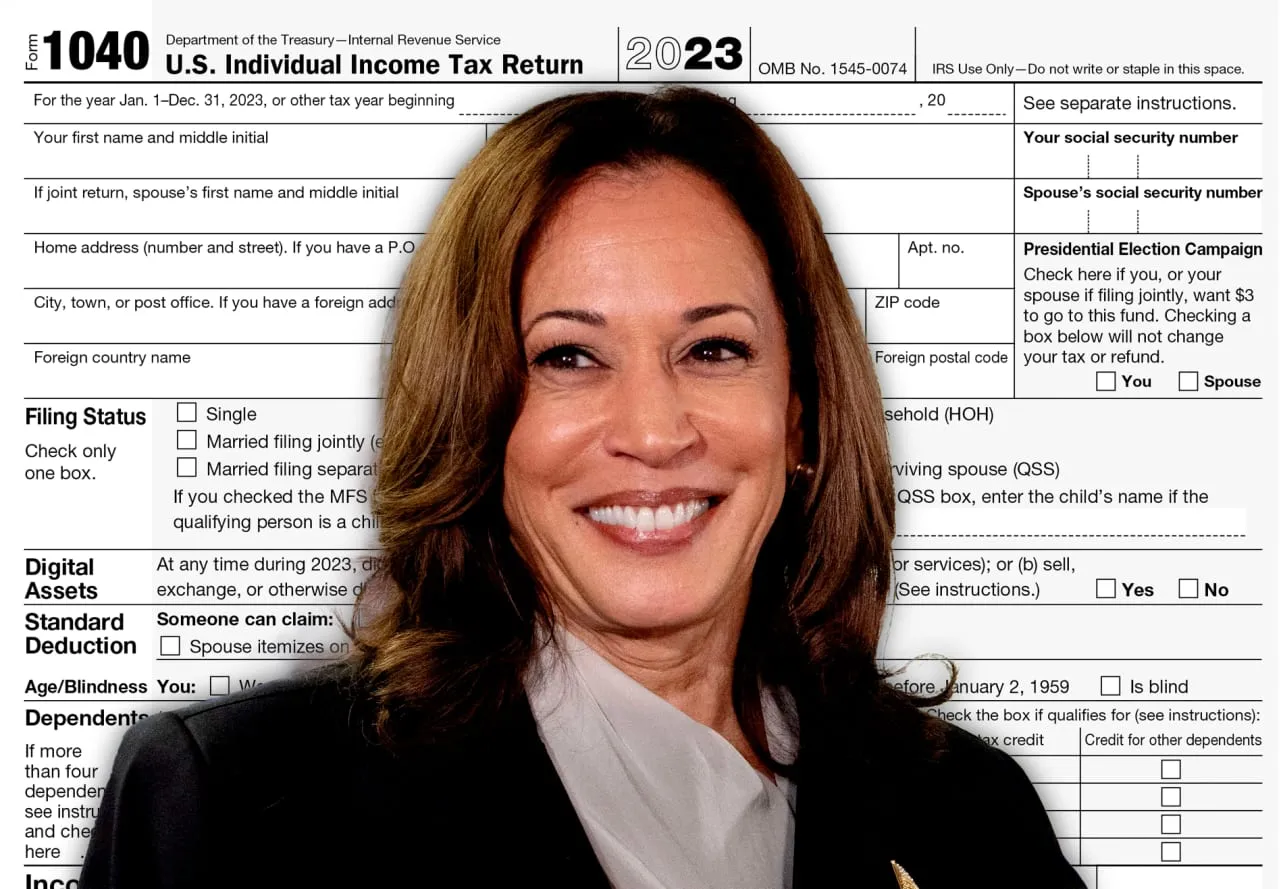

Election2024: Kamala Harris Supports Biden’s Tax Plans Focused on Economic Growth

Election2024: Harris's Support for Biden’s Tax Proposals

In a pivotal moment for Election2024, Kamala Harris has publicly endorsed President Joe Biden's economic strategies, particularly a compelling tax on unrealized capital gains. This initiative exclusively targets individuals with assets exceeding $100 million, intending to address wealth inequalities through taxation.

Implications of the Capital Gains Tax

- The proposed unrealized capital gains tax could have far-reaching impacts on financial performance.

- This measure aims to bridge the gap in government finance by ensuring that wealthy individuals contribute more fairly to the economy.

- Harris's backing signals a potential shift in regulation and government policy surrounding taxation.

Analyzing the Broader Impact

This support also reflects broader trends in politics and government policy, as the Democratic party seeks to bolster its agenda ahead of the upcoming elections. As the financial landscape shifts, investors and stakeholders in sectors like technology, financial services, and industrial goods may need to reassess their strategies.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.