The 'Magnificent Seven' Are Losing Their Crown in the Stock Market

The Shift in Market Leadership

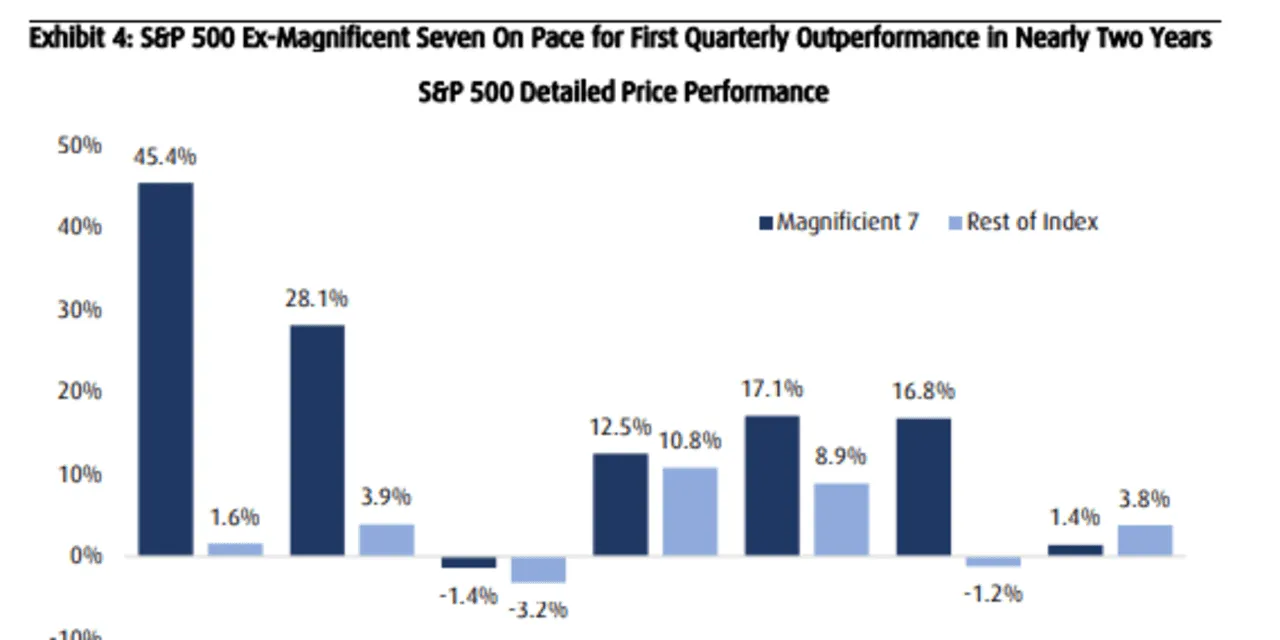

As U.S. stocks have roared back from their summertime slump, the elite group known as the 'Magnificent Seven' is showing signs of losing its grip on the market's crown. Since the start of the third quarter, shares of these megacap companies have been trailing behind the rest of the S&P 500. This signals a pivotal moment for investors

Performance Comparison

- The 'Magnificent Seven' has underperformed against 493 other S&P 500 companies.

- Trends indicate that this may be the first quarter in nearly two years for such underperformance.

Implications for Investors

The loss of dominance by the 'Magnificent Seven' raises important questions for market participants. This shift highlights the necessity for diversifying strategies. Investors may want to explore alternative sectors that could benefit in a changing market landscape.

Conclusion

In light of these developments, it is crucial for stakeholders to recalibrate their portfolios and consider the potential for growth beyond the traditional megacaps.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.