Exploring the Pros and Cons of Investing in Solventum After the 3M Spinoff

Introducing Solventum

Solventum is a healthcare company operating in four segments with a combined market size of over $8 billion, showing steady growth projections across its divisions.

Investment Case and Valuation

The stock offers a compelling valuation at less than eight times its minimum free cash flow in the last three years, signaling potential for value investors.

Negatives to Consider

- Debt Burden: Solventum's substantial debt burden and interest expenses pose challenges for future free cash flow generation.

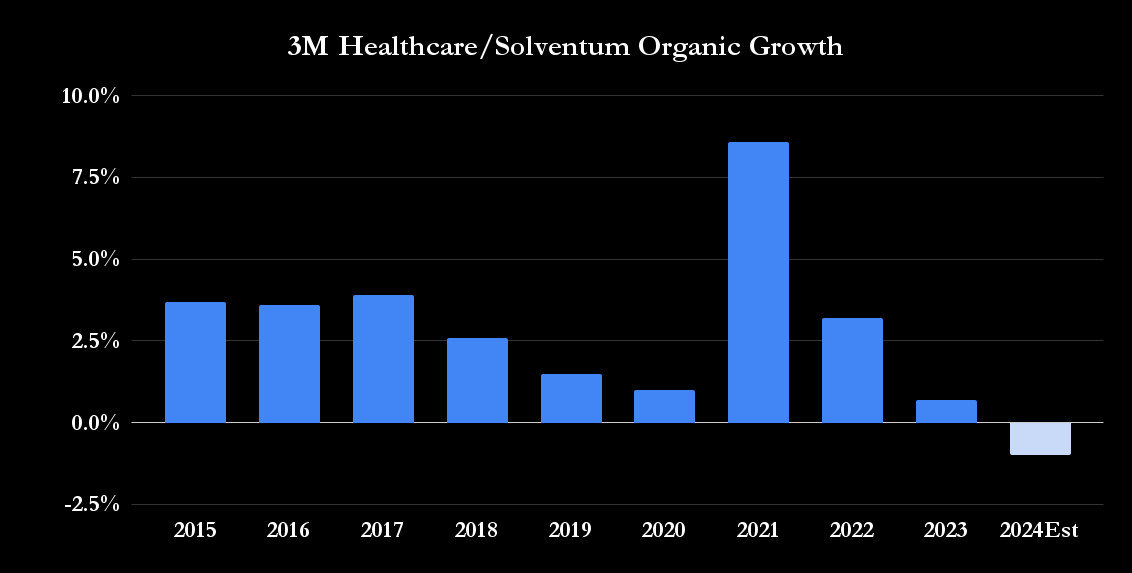

- Weak Growth Record: Stagnant growth rates and revising growth estimates raise concerns over Solventum's long-term performance.

- Restructuring Challenges: Previous merger activities and SKU rationalization plans indicate potential operational challenges for Solventum.

Despite these concerns, the impact of the 3M spinoff on both companies remains a subject of interest for investors.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.