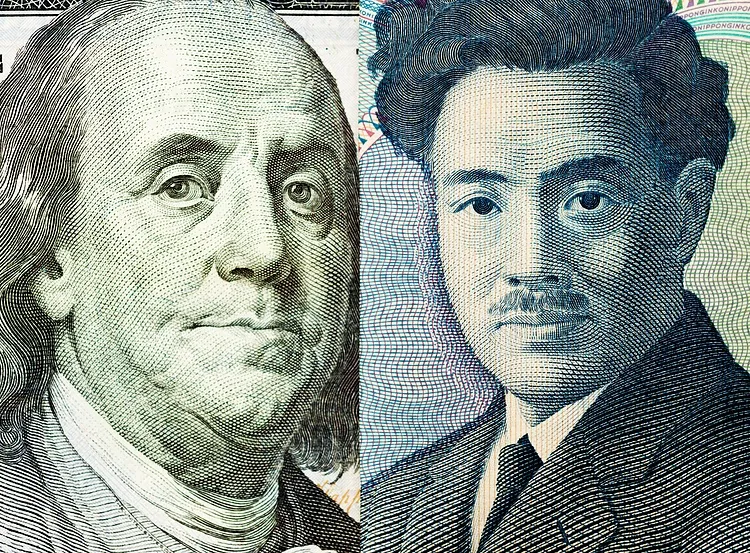

USDJPY Technical Analysis: Insights into Banks' Impact on Currency Movements

Technical Analysis of USDJPY

The USDJPY pair has shown noteworthy changes in response to financial institutions, particularly as the Japanese Yen (JPY) recovers from significant losses. According to DBS Senior FX Strategist Philip Wee, the Yen has reduced this year's losses to -2.8% YTD on Tuesday, a considerable improvement from -13% in early July.

Impact of Banks on Currency Movements

As the carry trades unwind, market participants are closely watching how banks react to these shifts. The analysis indicates that recent moves may signal a newfound strength in the JPY as institutions recalibrate their strategies.

Future Implications

Moving forward, traders should monitor USDJPY closely, as technical analysis continues to reveal essential insights into banks' roles. The current market conditions suggest potential for further stability and opportunities.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.