NTSX: Analyzing the Leveraged Bond/Equity ETF's Position in a Normalizing Inflation Environment

The NTSX ETF, centered on leveraging the bond and equity markets, is structured to provide exposure to 90% equities alongside 60% Treasuries. As inflation shows signs of normalization, the strategic use of futures enables this fund to amplify its gains, capturing the upward momentum desired by investors.

Investment Potential of NTSX

Investors are increasingly interested in leveraged funds like NTSX due to their dual exposure, which positions them favorably in current market conditions. Let's delve into the core elements that make this ETF appealing.

Key Features of NTSX

- High Equity Exposure: The majority of NTSX’s investment goes into equities, potentially maximizing returns.

- Bond Diversification: With significant treasury holdings, NTSX also manages risk effectively.

- Futures Leverage: The strategic use of futures enhances the fund’s ability to generate profits.

Market Implications

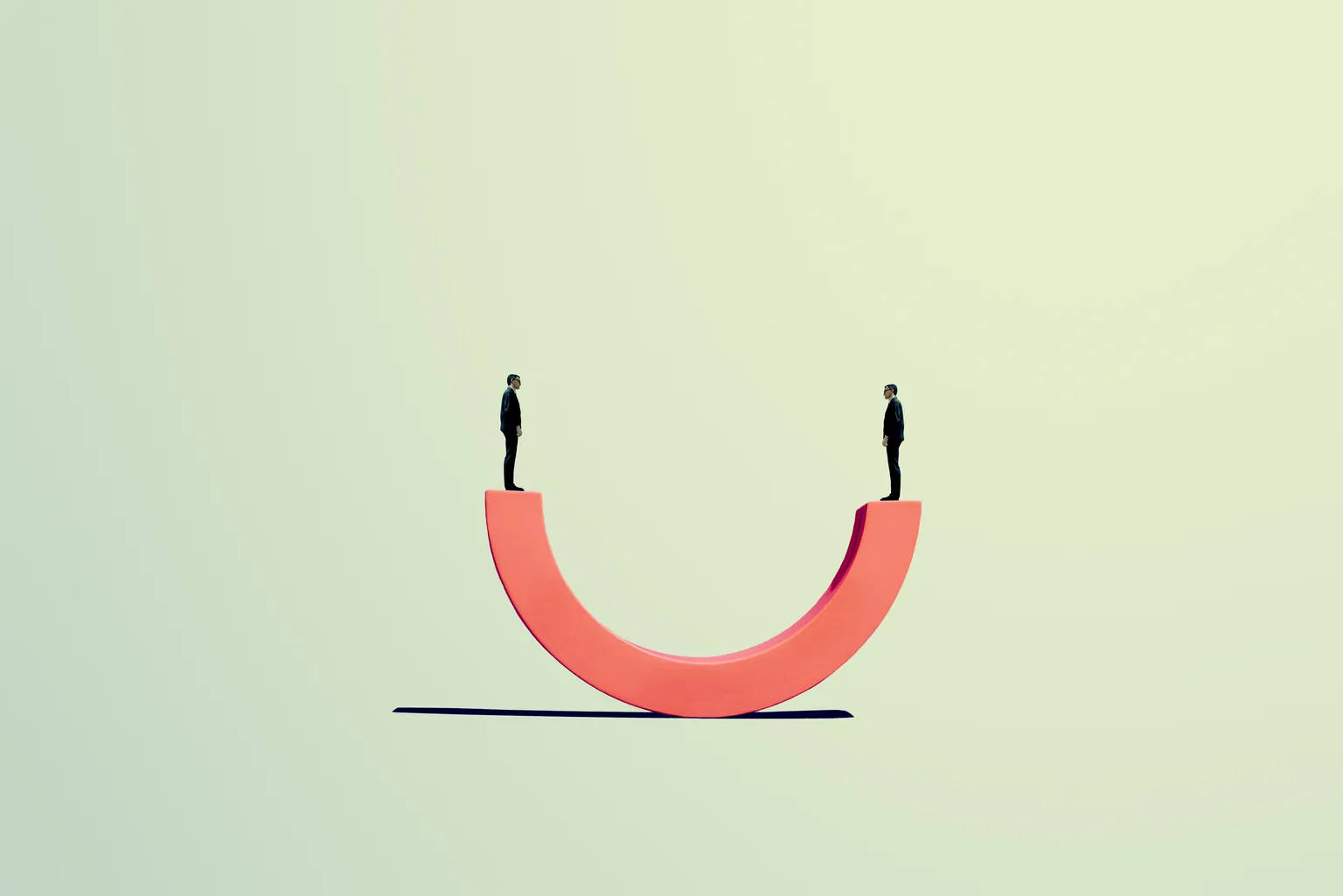

Given the current economic landscape, NTSX provides a compelling option for those looking to balance risk and reward. As inflation stabilizes, managing portfolios through ETFs like NTSX can yield substantial returns.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.